Expertise Provided by Mark Robertson

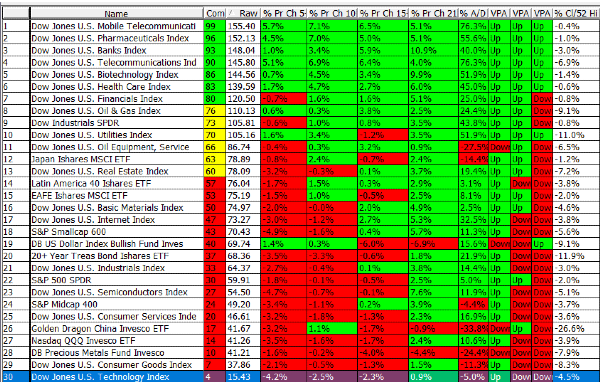

Some sectors in the active stock market have stood out due to strong performance. Specifically, industrial stocks have stood out. These stocks have surged. This prompts an exploration into the factors driving their success. We will understand the forces behind their upward trajectory. We will identify thriving industries within the sector. Then, we will analyze the distinct characteristics that define the industrial landscape. This comprehensive examination aims to shed light on why industrial stocks are thriving. It also aims to explore what is propelling their ascent. It also examines the promising industries poised for growth. It also examines the driving forces steering the industrial sector. It also examines the key traits setting it apart in the ever-evolving financial markets.

Factors Driving the Rise in Industrial Stocks

Industrials are on the rise, and here's why:

1. Cyclical Nature:

Imagine envisioning the sector as a cycle up and sometimes down. Currently it is experiencing an upswing. This occurs because industrial stocks tend to thrive when there is growth. Therefore, when people increase their spending, new infrastructure projects emerge. Global trade also expands. This creates an environment for industrial companies to flourish.

2. Economic Expansion:

Traditionally industrial stocks tend to thrive when the economy is growing. This indicates that more people are purchasing goods. Governments are investing in infrastructure projects. These projects include roads and bridges. Businesses are experiencing growth. As the overall economy strengthens, industries within the sector witness a demand for their products. This leads to an increase in their stock prices.

3. Recovery from Downturns:

When economies recover from times it brings an impact on industrial companies. Following a period of slowdown or recession there is a pent-up demand for goods and services. Industries within the industrial sector aim to meet this demand. This leads to a trajectory for their stocks.

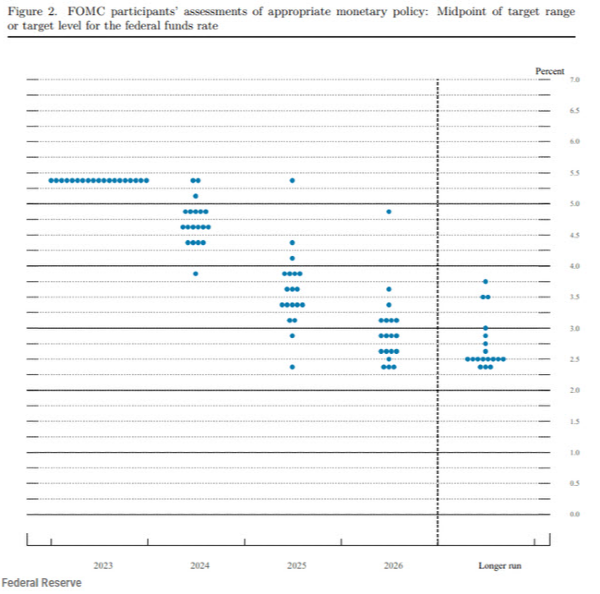

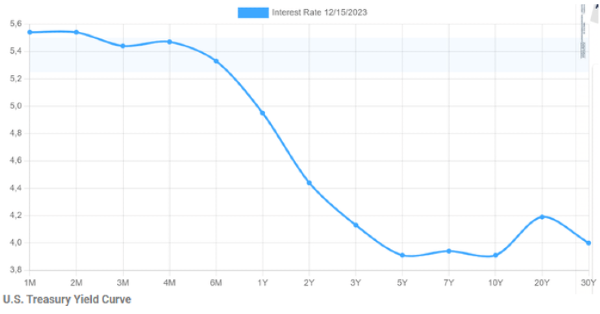

4. Affordable Borrowing:

Imagine this scenario. If you were considering buying something like a house or a car and the interest rates were low, it would be a good time to borrow money. The same applies to businesses, including companies. Lower interest rates are available. They can access affordable borrowing options easily. This encourages them to invest in expanding their operations. It also motivates them to upgrade their technology. This helps them maintain competitiveness. All of which contribute towards boosting their stock values.

5. Capital Access:

In this context "capital" refers to resources, for businesses.

In an environment of interest rates, industrial companies enjoy the advantage of access to capital. This implies that they can obtain the funds to support initiatives. They can enhance their production methods and meet the evolving demands of customers. Having access to capital enables them to maintain an edge, in the market, which is highly appreciated by investors.

Source: Investopedia

Source: Investopedia

What Industries Will Be Booming?

There are industries, within the sector that are expected to see substantial expansion in the years ahead;

- Renewable Energy Sector's Green Revolution:

The world is moving towards more sustainable practices. There is a growing demand for renewable energy sources. These sources include wind and solar power. Companies involved in manufacturing energy equipment constructing eco infrastructure and developing sustainable technologies are likely to experience significant growth.

- Aerospace and Defense Industry's Soaring Demand:

Because of tensions between countries, there's a big demand for stuff like planes and defense gear. Governments are spending more on defense, and companies making planes and defense tech are getting lots of orders. It's like the safety industry is growing because countries want to make sure they're protected.

- Industry 4.0's Technological Revolution:

When technology is used a lot in making things, they call it Industry 4.0, and it's changing how things work. Companies that use smart technology, robots, and data analysis in their work get ahead. This change not only makes things work better but also opens up new chances for companies to grow in the industrial world.

Key Drivers of the Industrials Sector

The Industrials Sector is influenced by factors that drive its performance. These factors also shape its distinctive qualities.

1. Economic Cycles:

Similar, to a rollercoaster ride this sector experiences the ups and downs of fluctuations. When economies are thriving, there is a demand for goods and services. This demand is driven by factors such as investments in infrastructure. It's also driven by consumer spending and global trade. This results in increased production. It also leads to improved profitability and higher stock prices.

2. Government Spending:

Governments help the economy by putting money into building things like roads and clean energy. This creates jobs for builders and helps other industries grow too. Also, when they spend on defense, it helps the companies that make planes and other defense stuff to grow. So, by investing in these things, governments make our country's money situation better.

3. Technological Advancements:

Factories and businesses are using cool technologies like robots, AI, and 3D printing to work better. This makes them faster, more efficient, and the things they make are even better quality. It helps them compete well and catch the eye of people who want to invest in them.

4. Globalization:

In today's world, companies make things and get materials from all over the place. This helps them save money, but it also means they face problems like trade wars and money value changes. On the plus side, this way of trading globally also makes a big need for shipping and logistics services.

5. Consumer Spending:

When folks are happy with their money and have plenty, they go shopping for cars, appliances, and home upgrades. This shopping spree is great for companies that make things and the stores that sell them. It helps these businesses grow. So, how much people spend has a big impact on how well these companies do.

6. Regulation:

Companies in the industrial sector must follow certain rules to keep everyone safe. They must also take care of the environment and treat workers well. Even though it might cost more, following these rules makes things work well and builds trust with customers. Companies that do this right end up doing better.

Characteristics of the Industrial Sector:

The industrial sector plays a role in any economy. It encompasses companies engaged in manufacturing, construction, aerospace, transportation, and more. Here's a brief overview of its characteristics:

1. Cyclical:

This sectors performance is closely linked to the health of the economy. During periods of expansion there is an increase, in the demand for industrial products and services. This surge in demand subsequently leads to levels of production and an upward trend in stock prices. Conversely, economic downturns can result in a decline in demand and profitability. This creates circumstances for businesses.

2. Capital Intensive:

Making things in industries often needs a lot of money for machines, buildings, and materials. This can make it hard for new companies to start and compete. It also makes existing companies less flexible in how they operate.

3. Long-Term Investment Horizon:

Many industrial products are made in different countries around the world. That's why it's cheaper and easier to find the materials needed. However, trade wars, political problems, and currency value changes can make it difficult to make or sell products.

4. Globalized:

Many industrial goods rely on production and supply chains that span across countries. This is due to factors like cost efficiency and resource availability. However, this exposes the sector to risks. These include trade wars. Also, political instability and currency fluctuations.

5. Focus on Innovation:

Technological advancements reshape the landscape. They give companies an edge if they use automation, digitalization, and new materials.

6. Regulation:

Companies in this area need to follow rules to keep things safe, protect the environment, and treat workers well. These rules affect how much it costs to run the business and what they have to do to follow the law.

Source: Maritime Gateway

Source: Maritime Gateway

Advantages of Investing in Industrial stocks

Investing in stocks provides advantages for investors. They explore opportunities in the stock market. Here are some key benefits to consider:

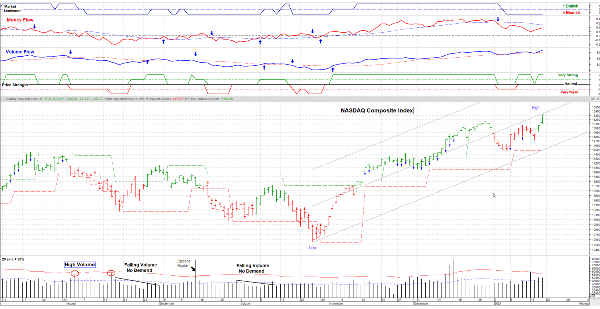

1. Cyclical Growth Potential:

Industrial stocks often follow patterns that align with cycles. When the economy expands, there is typically an increased demand for goods and services. This leads to higher revenue and profitability for companies in this sector. By timing their investments investors can potentially enjoy returns.

2. Diversification Benefits:

Putting stocks in your investment plan can help you manage risks better. The industrial sector includes things like making stuff, building, aerospace, and transportation. When you have a mix of stocks from different areas, it helps spread out the risk. So, if one industry doesn't do well, it won't hurt your investment too much.

3. Infrastructure Spending Impact:

When the government invests in building things like roads and bridges, it affects the industry. Policies that encourage this kind of development create more demand for products and services. Investors can gain from these government efforts because they help the sector grow.

4. Global Economic Exposure:

Many big companies in industries like manufacturing and trade operate globally. They grow along with economies worldwide. Investing in stocks from these companies gives you a chance to benefit from the changing global economy. You can also grab opportunities that arise because countries are connected all over the world.

5. Innovation and Technological Advancements:

In the industrial world, companies are always trying to be more efficient and competitive. If you invest in their stocks, you might benefit from them using new technologies and advancements, putting you at the forefront of innovation.

Risks of investing in industrial stocks

Although the recent surge in stocks may seem enticing. It is important to remember that every investment comes with its share of risks. Before delving into the sector it is crucial to consider the following risks:

1. Cyclical Nature:

Just like roller coasters, stocks in the industrial sector can go up and down. Economic problems, trade issues, or events in the world can make the stock prices go down, leading to big losses. To reduce this risk, it's a good idea to spread out your investments and think about the long term instead of just short-term gains.

2. Capital Intensity:

Investing in the industrial sector is like spending money. It's for building factories. It's for getting machines. It's for managing supply chains. But if costs suddenly go up or things get messed up, it can make it harder for companies to make money. This can affect the prices of their stocks.

3. Global Dependence:

Many industrial companies operate on a large scale. This makes them susceptible to risks. For example, currency fluctuations. They're also vulnerable to political instability in markets. They're also vulnerable to disruptions in international trade. When considering investments in this sector, it is crucial to understand country level risks.

4. Environmental Regulations:

With the growing concern, for the environment there is a push for stringent regulations. This could result in increased costs for companies to meet emission standards and properly dispose of waste. It is crucial to assess how these regulations will affect industries.

5. Competition:

The industrial sector is known for its competition both domestically and globally. This constant drive to cut costs and foster innovation puts pressure on profit margins.

Source: Investopedia

Source: Investopedia

Conclusion:

In a nutshell, the rise in stocks can be attributed to a flourishing economy and increased consumer demand for goods. It is also due to infrastructure development and global trade. It's akin to a rollercoaster ride with its ups and downs. Currently, low interest rates facilitate business borrowing. We're on a trajectory due to this. This enables companies to invest in growth and improvements. This appeals to investors. Certain industries within the sector, such as energy and aerospace, are expected to grow substantially. Nevertheless, it's crucial to acknowledge the risks associated with investing in stocks. This includes substantial fluctuations. It also includes high capital requirements for projects. And, it includes formidable competition. If you're considering investment opportunities, in this realm exercise caution.

Read more about Industrial Stocks in our ongoing sector series:

The Top Industrial Stocks

Are Industrials a Good Investment?

The Best Industrial ETFs

How do you Evaluate Industrial Stocks?

What is the Manufacturing Sector

Industrial Stocks with Dividends

Why Invest in Manufacturing Stocks

Important Manufacturing Sector Ratios

Why are Industrial Stocks Doing Well

What Affects the Industrial Industry?

Expertise Provided by Mark Robertson

Some sectors in the active stock market have stood out due to strong performance. Specifically, industrial stocks have stood out. These stocks have surged. This prompts an exploration into the factors driving their success. We will understand the forces behind their upward trajectory. We will identify thriving industries within the sector. Then, we will analyze the distinct characteristics that define the industrial landscape. This comprehensive examination aims to shed light on why industrial stocks are thriving. It also aims to explore what is propelling their ascent. It also examines the promising industries poised for growth. It also examines the driving forces steering the industrial sector. It also examines the key traits setting it apart in the ever-evolving financial markets. Factors Driving the Rise in Industrial Stocks Industrials are on the rise, and here's why:

1. Cyclical Nature:

Imagine envisioning the sector as a cycle up and sometimes down. Currently it is experiencing an upswing. This occurs because industrial stocks tend to thrive when there is growth. Therefore, when people increase their spending, new infrastructure projects emerge. Global trade also expands. This creates an environment for industrial companies to flourish.

2. Economic Expansion:

Traditionally industrial stocks tend to thrive when the economy is growing. This indicates that more people are purchasing goods. Governments are investing in infrastructure projects. These projects include roads and bridges. Businesses are experiencing growth. As the overall economy strengthens, industries within the sector witness a demand for their products. This leads to an increase in their stock prices.

3. Recovery from Downturns:

When economies recover from times it brings an impact on industrial companies. Following a period of slowdown or recession there is a pent-up demand for goods and services. Industries within the industrial sector aim to meet this demand. This leads to a trajectory for their stocks.

4. Affordable Borrowing:

Imagine this scenario. If you were considering buying something like a house or a car and the interest rates were low, it would be a good time to borrow money. The same applies to businesses, including companies. Lower interest rates are available. They can access affordable borrowing options easily. This encourages them to invest in expanding their operations. It also motivates them to upgrade their technology. This helps them maintain competitiveness. All of which contribute towards boosting their stock values.

5. Capital Access:

In this context "capital" refers to resources, for businesses. In an environment of interest rates, industrial companies enjoy the advantage of access to capital. This implies that they can obtain the funds to support initiatives. They can enhance their production methods and meet the evolving demands of customers. Having access to capital enables them to maintain an edge, in the market, which is highly appreciated by investors.

What Industries Will Be Booming?

There are industries, within the sector that are expected to see substantial expansion in the years ahead;

Key Drivers of the Industrials Sector

The Industrials Sector is influenced by factors that drive its performance. These factors also shape its distinctive qualities.

1. Economic Cycles:

Similar, to a rollercoaster ride this sector experiences the ups and downs of fluctuations. When economies are thriving, there is a demand for goods and services. This demand is driven by factors such as investments in infrastructure. It's also driven by consumer spending and global trade. This results in increased production. It also leads to improved profitability and higher stock prices.

2. Government Spending:

Governments help the economy by putting money into building things like roads and clean energy. This creates jobs for builders and helps other industries grow too. Also, when they spend on defense, it helps the companies that make planes and other defense stuff to grow. So, by investing in these things, governments make our country's money situation better.

3. Technological Advancements:

Factories and businesses are using cool technologies like robots, AI, and 3D printing to work better. This makes them faster, more efficient, and the things they make are even better quality. It helps them compete well and catch the eye of people who want to invest in them.

4. Globalization:

In today's world, companies make things and get materials from all over the place. This helps them save money, but it also means they face problems like trade wars and money value changes. On the plus side, this way of trading globally also makes a big need for shipping and logistics services.

5. Consumer Spending:

When folks are happy with their money and have plenty, they go shopping for cars, appliances, and home upgrades. This shopping spree is great for companies that make things and the stores that sell them. It helps these businesses grow. So, how much people spend has a big impact on how well these companies do.

6. Regulation:

Companies in the industrial sector must follow certain rules to keep everyone safe. They must also take care of the environment and treat workers well. Even though it might cost more, following these rules makes things work well and builds trust with customers. Companies that do this right end up doing better.

Characteristics of the Industrial Sector:

The industrial sector plays a role in any economy. It encompasses companies engaged in manufacturing, construction, aerospace, transportation, and more. Here's a brief overview of its characteristics:

1. Cyclical:

This sectors performance is closely linked to the health of the economy. During periods of expansion there is an increase, in the demand for industrial products and services. This surge in demand subsequently leads to levels of production and an upward trend in stock prices. Conversely, economic downturns can result in a decline in demand and profitability. This creates circumstances for businesses.

2. Capital Intensive:

Making things in industries often needs a lot of money for machines, buildings, and materials. This can make it hard for new companies to start and compete. It also makes existing companies less flexible in how they operate.

3. Long-Term Investment Horizon:

Many industrial products are made in different countries around the world. That's why it's cheaper and easier to find the materials needed. However, trade wars, political problems, and currency value changes can make it difficult to make or sell products.

4. Globalized:

Many industrial goods rely on production and supply chains that span across countries. This is due to factors like cost efficiency and resource availability. However, this exposes the sector to risks. These include trade wars. Also, political instability and currency fluctuations.

5. Focus on Innovation:

Technological advancements reshape the landscape. They give companies an edge if they use automation, digitalization, and new materials.

6. Regulation:

Companies in this area need to follow rules to keep things safe, protect the environment, and treat workers well. These rules affect how much it costs to run the business and what they have to do to follow the law.

Advantages of Investing in Industrial stocks

Investing in stocks provides advantages for investors. They explore opportunities in the stock market. Here are some key benefits to consider:

1. Cyclical Growth Potential:

Industrial stocks often follow patterns that align with cycles. When the economy expands, there is typically an increased demand for goods and services. This leads to higher revenue and profitability for companies in this sector. By timing their investments investors can potentially enjoy returns.

2. Diversification Benefits:

Putting stocks in your investment plan can help you manage risks better. The industrial sector includes things like making stuff, building, aerospace, and transportation. When you have a mix of stocks from different areas, it helps spread out the risk. So, if one industry doesn't do well, it won't hurt your investment too much.

3. Infrastructure Spending Impact:

When the government invests in building things like roads and bridges, it affects the industry. Policies that encourage this kind of development create more demand for products and services. Investors can gain from these government efforts because they help the sector grow.

4. Global Economic Exposure:

Many big companies in industries like manufacturing and trade operate globally. They grow along with economies worldwide. Investing in stocks from these companies gives you a chance to benefit from the changing global economy. You can also grab opportunities that arise because countries are connected all over the world.

5. Innovation and Technological Advancements:

In the industrial world, companies are always trying to be more efficient and competitive. If you invest in their stocks, you might benefit from them using new technologies and advancements, putting you at the forefront of innovation.

Risks of investing in industrial stocks

Although the recent surge in stocks may seem enticing. It is important to remember that every investment comes with its share of risks. Before delving into the sector it is crucial to consider the following risks:

1. Cyclical Nature:

Just like roller coasters, stocks in the industrial sector can go up and down. Economic problems, trade issues, or events in the world can make the stock prices go down, leading to big losses. To reduce this risk, it's a good idea to spread out your investments and think about the long term instead of just short-term gains.

2. Capital Intensity:

Investing in the industrial sector is like spending money. It's for building factories. It's for getting machines. It's for managing supply chains. But if costs suddenly go up or things get messed up, it can make it harder for companies to make money. This can affect the prices of their stocks.

3. Global Dependence:

Many industrial companies operate on a large scale. This makes them susceptible to risks. For example, currency fluctuations. They're also vulnerable to political instability in markets. They're also vulnerable to disruptions in international trade. When considering investments in this sector, it is crucial to understand country level risks.

4. Environmental Regulations:

With the growing concern, for the environment there is a push for stringent regulations. This could result in increased costs for companies to meet emission standards and properly dispose of waste. It is crucial to assess how these regulations will affect industries.

5. Competition:

The industrial sector is known for its competition both domestically and globally. This constant drive to cut costs and foster innovation puts pressure on profit margins.

Conclusion:

In a nutshell, the rise in stocks can be attributed to a flourishing economy and increased consumer demand for goods. It is also due to infrastructure development and global trade. It's akin to a rollercoaster ride with its ups and downs. Currently, low interest rates facilitate business borrowing. We're on a trajectory due to this. This enables companies to invest in growth and improvements. This appeals to investors. Certain industries within the sector, such as energy and aerospace, are expected to grow substantially. Nevertheless, it's crucial to acknowledge the risks associated with investing in stocks. This includes substantial fluctuations. It also includes high capital requirements for projects. And, it includes formidable competition. If you're considering investment opportunities, in this realm exercise caution.

Read more about Industrial Stocks in our ongoing sector series:

The Top Industrial Stocks

Are Industrials a Good Investment?

The Best Industrial ETFs

How do you Evaluate Industrial Stocks?

What is the Manufacturing Sector

Industrial Stocks with Dividends

Why Invest in Manufacturing Stocks

Important Manufacturing Sector Ratios

Why are Industrial Stocks Doing Well

What Affects the Industrial Industry?