I interviewed Bob Wynn of ClimbUSA.org in December 2022. Check out that interview here:

https://youtu.be/Y9WSGp2uK-Q

What is a stock selection guide?

The stock selection guide is a stock picking methodology created by BetterInvesting™.

The title really helps to define what it is. Stocks are sort of like people. There are some that are good and there are some that are not so good. We have discerned our own methodology to determine if a person is good based on the metrics that we set in terms of a person being polite, intelligent, and respectful. For stocks we have that too. It is very simple for stocks because it boils down to what Bob Wynn tells his 8th grade climb youth leaders: that sales drives earnings, and earnings drive the stock price.

Ultimately, we are looking for an increase in the stock price of those companies that we buy. To do this, we must buy low and sell high. The stock selection guide takes us into an in-depth analysis of the historical sales trends of companies and in turn looks at the earnings that are derived from those sales and it’s those stocks that have the consistent upwards trends that are manifest through our stock selection guide process.

Why Should a New Investor Try the Stock Selection Guide (SSG)?

There are different strategies to use to invest like momentum, value, technical analysis. When working with young people, Bob would use a sports analogy. He tells them that a coach that is worth their salt is not going to teach them the alley-oop before they teach you the lay-up. The SSG keeps you in the lane of investing basics and it does track with the main methodology which is called fundamental analysis. Fundamental analysis is the layup level of learning about stock investing. It is ill advised to learn too much to quickly. It is important to nail down the fundamentals of how to analyze companies before you get into more sophisticated analytical methodologies.

Image by Varun Kulkarni from Pixabay. You need to learn a lay-up before you learn the alley-oop. The Stock Selection Guide helps new users learn the fundamentals of investing

How Can New Investors Prepare Before Using a Stock Selection Guide?

This is the reason why climbUSA.org compliments BetterInvesting™. There are some basics that people should learn before they engage in a stock selection guide. First off, there is terminology in business that, just like in sports or other disciplines, that you need to learn and be familiar with so that you can grapple with the tools of the SSG.

Read More: betterInvesting.org terminology and resources

The other is to learn about data sources. The SSG needs data feeds: the real time information that comes in about stocks and their trends like earnings. Its helpful to get familiar with these resources like:

When new users go to learn the SSG, these individuals will be prepared to use the SSG.

How Does ClimbUSA.org Compliment the Stock Selection Guide?

Historically, BetterInvesting™ has worked a lot with the adult population. When Bob learned about investing, especially the power of compounding returns, it was imperative that he begin to acquaint younger people with the process of investing and to help them understand why it is important that they grasp the understanding and put it into practice at an early age.

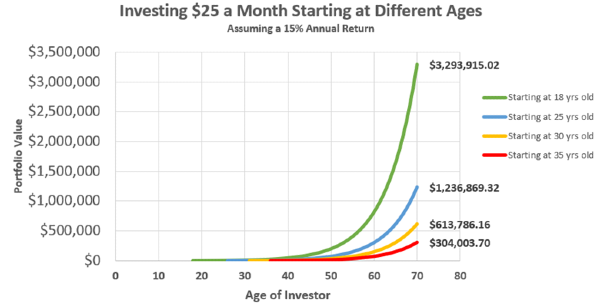

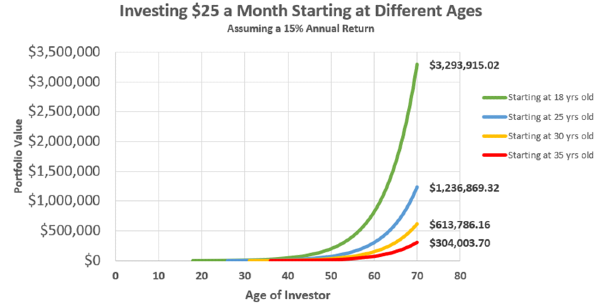

In learning about the SSG, you’ll learn that there is a strict correlation between the rate of return and the time in which you can double your money. And if you think about the fact that in our life span, we only have a finite number of times that we can double our money, especially if we are assuming a rate of return as high as 15% annually (which is as high as you should ever assume). Its going to mean that you can double your money every 5 years.

Investing $25 a month and starting at different ages. If you start when you are 18, you will have over $3 million in your portfolio when you are 70. This assumes a 15% return annually.

If you live to be 100 years old, you can double your money a maximum 20 times, but more realistically 15 doubles is the best you could do. Think of those last two doubles, if you are 65 and you have $250k, at 70 you have $500k, then at 75 you have $1million. Where are you when you only have two more doubles left? Therefore, the earlier you get started the better off you will be.

This is all assuming the health of our economy. And that is why it’s so important that you listen in to what is going on with geopolitics and global economic data. Because our companies we invest in will do no better than the global economy as a whole. And assuming the economy continues to grow around the globe, there will be opportunities for companies to grow in turn. And if you’re an investor in those companies you have that opportunity as well.

Read More: The Latest Macroeconomic News and Analysis

So, climb is really dedicated to reaching youth and reaching those adults who serve youth especially those that come from historically underserved population groups and getting people oriented towards what we call the economic way of thinking, which includes investing but it also includes understanding the lifestyle of successful careerists as well.

Final Thoughts

The Stock Selection Guide gives new investors a methodology to assess a stock’s fundamentals to make a better investment decision. Before a new investor starts with an SSG, they should take some time to learn business terminology and get familiar with stock data sources.

For youth, climbUSA.org is helping to organize, teach, and raise awareness of “Community Based Investment Enterprises”. These are community investment clubs that help youth get into investing and use stock selection guides.

Learn More

Help us get more youth investing at climbUSA.org

Want to try the stock selection guide? Check out https://www.betterinvesting.org/ Try a 90 day free trial of BetterInvesting! Get your free trial here: https://bit.ly/3gM1uyX

Find the top SSG analysis on the SSG Topics Page

Check out our companion video where I interview Bob Wynn here:

https://youtu.be/Y9WSGp2uK-Q

I interviewed Bob Wynn of ClimbUSA.org in December 2022. Check out that interview here:

https://youtu.be/Y9WSGp2uK-Q

What is a stock selection guide?

The stock selection guide is a stock picking methodology created by BetterInvesting™.

The title really helps to define what it is. Stocks are sort of like people. There are some that are good and there are some that are not so good. We have discerned our own methodology to determine if a person is good based on the metrics that we set in terms of a person being polite, intelligent, and respectful. For stocks we have that too. It is very simple for stocks because it boils down to what Bob Wynn tells his 8th grade climb youth leaders: that sales drives earnings, and earnings drive the stock price.

Ultimately, we are looking for an increase in the stock price of those companies that we buy. To do this, we must buy low and sell high. The stock selection guide takes us into an in-depth analysis of the historical sales trends of companies and in turn looks at the earnings that are derived from those sales and it’s those stocks that have the consistent upwards trends that are manifest through our stock selection guide process.

Why Should a New Investor Try the Stock Selection Guide (SSG)?

There are different strategies to use to invest like momentum, value, technical analysis. When working with young people, Bob would use a sports analogy. He tells them that a coach that is worth their salt is not going to teach them the alley-oop before they teach you the lay-up. The SSG keeps you in the lane of investing basics and it does track with the main methodology which is called fundamental analysis. Fundamental analysis is the layup level of learning about stock investing. It is ill advised to learn too much to quickly. It is important to nail down the fundamentals of how to analyze companies before you get into more sophisticated analytical methodologies.

Image by Varun Kulkarni from Pixabay. You need to learn a lay-up before you learn the alley-oop. The Stock Selection Guide helps new users learn the fundamentals of investing

How Can New Investors Prepare Before Using a Stock Selection Guide?

This is the reason why climbUSA.org compliments BetterInvesting™. There are some basics that people should learn before they engage in a stock selection guide. First off, there is terminology in business that, just like in sports or other disciplines, that you need to learn and be familiar with so that you can grapple with the tools of the SSG.

The other is to learn about data sources. The SSG needs data feeds: the real time information that comes in about stocks and their trends like earnings. Its helpful to get familiar with these resources like:

When new users go to learn the SSG, these individuals will be prepared to use the SSG.

How Does ClimbUSA.org Compliment the Stock Selection Guide?

Historically, BetterInvesting™ has worked a lot with the adult population. When Bob learned about investing, especially the power of compounding returns, it was imperative that he begin to acquaint younger people with the process of investing and to help them understand why it is important that they grasp the understanding and put it into practice at an early age.

In learning about the SSG, you’ll learn that there is a strict correlation between the rate of return and the time in which you can double your money. And if you think about the fact that in our life span, we only have a finite number of times that we can double our money, especially if we are assuming a rate of return as high as 15% annually (which is as high as you should ever assume). Its going to mean that you can double your money every 5 years.

Investing $25 a month and starting at different ages. If you start when you are 18, you will have over $3 million in your portfolio when you are 70. This assumes a 15% return annually.

If you live to be 100 years old, you can double your money a maximum 20 times, but more realistically 15 doubles is the best you could do. Think of those last two doubles, if you are 65 and you have $250k, at 70 you have $500k, then at 75 you have $1million. Where are you when you only have two more doubles left? Therefore, the earlier you get started the better off you will be.

This is all assuming the health of our economy. And that is why it’s so important that you listen in to what is going on with geopolitics and global economic data. Because our companies we invest in will do no better than the global economy as a whole. And assuming the economy continues to grow around the globe, there will be opportunities for companies to grow in turn. And if you’re an investor in those companies you have that opportunity as well.

So, climb is really dedicated to reaching youth and reaching those adults who serve youth especially those that come from historically underserved population groups and getting people oriented towards what we call the economic way of thinking, which includes investing but it also includes understanding the lifestyle of successful careerists as well.

Final Thoughts

The Stock Selection Guide gives new investors a methodology to assess a stock’s fundamentals to make a better investment decision. Before a new investor starts with an SSG, they should take some time to learn business terminology and get familiar with stock data sources.

For youth, climbUSA.org is helping to organize, teach, and raise awareness of “Community Based Investment Enterprises”. These are community investment clubs that help youth get into investing and use stock selection guides.

Learn More

Help us get more youth investing at climbUSA.org Want to try the stock selection guide? Check out https://www.betterinvesting.org/ Try a 90 day free trial of BetterInvesting! Get your free trial here: https://bit.ly/3gM1uyX Find the top SSG analysis on the SSG Topics Page

Check out our companion video where I interview Bob Wynn here: https://youtu.be/Y9WSGp2uK-Q