Tuesday 9:45am - DNOWS Meetup

- What Trades do you have?

- How is your education going?

- Market/Industry/Bitcoin Technicals

- Stock, ETF, Crypto Alpha Boost Case Studies

Seabrook Discussion 7pm Wednesday

New Age Traders Noon Thursday

1. High Volatility: VIX > 25.

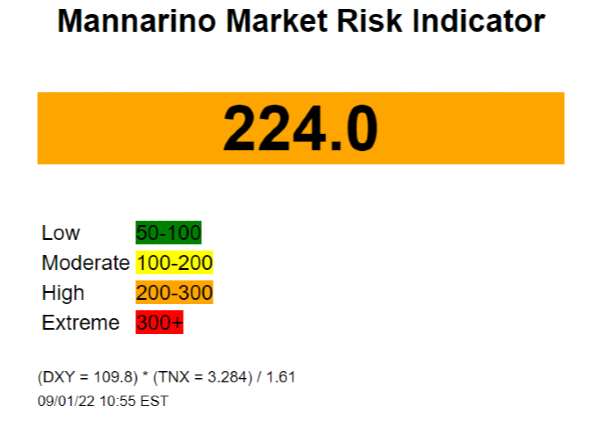

The Fed strikes Fear into the global markets.** Going forward, Bad Economic news is just bad news for the markets. Could we see a retest of the June lows before the midterm elections? Please keep your hedges on through the Midterm elections. The rise of both the US Dollar and Interest rates are hurting US Markets, Consumers and Businesses. The money printing machines are on full blast with the ECB buying Unlimited Bonds and the US $738 Billion Inflation Reduction Act. The new expected SPX range for this week: 4018 top and 3830 bottom.

2. US Dollar and 10 Year Interest Rate:

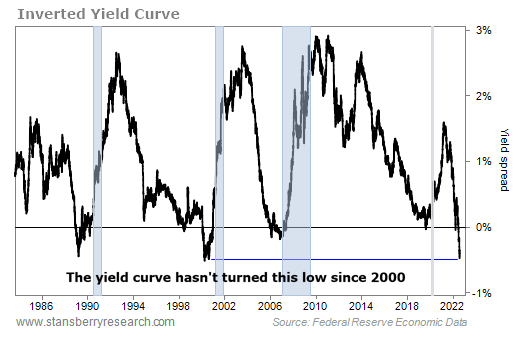

The US Dollar continues to rise near 110 with the EURO below US Dollar Parity. The 10Y Note Interest is above 3% and 30 year fixed rate mortgages are around 6-6.5%. The Yield curve for the 2year vs 10 year near 2000 levels. In the past, 2 negative GDP Quarters signaled a recession, but apparently this time is different?!?!? Long Term the US Dollar decline is still intact with Fiscal and Monetary stimulus flooding the world with US Dollars.

3. Crypto Currency:

Bitcoin is hovering around $20,000. Bitcoin has been range bound for 13 weeks between $18,500 and $24,000. Corporations, Countries, and Institutional investors are accumulating large Bitcoin positions. Please continue to Dollar Cost Average into Bitcoin and Ethereum. Crypto winter will last for another 10 months, as we wait for the next Bitcoin Halvening in 22 months. https://support.tastyworks.com/support/solutions/articles/43000612831-available-cryptocurrencies

4. Tasty Works Algo Trading System: James at Quiet Foundation

Alpha Boost ideas, sign up https://info.quietfoundation.com/alphaboost

https://issuu.com/luckbox/docs/2111-luckbox-site/56 Alph Boost Article

If you are new to options or this blog sounds like gibberish, please tryout Tasty Trade’s New 2020 Education. Includes 40 Videos, Testing and you get a certificate of completion at the end of the course.

https://tastytrade.thinkific.com/courses/beginner-options-course

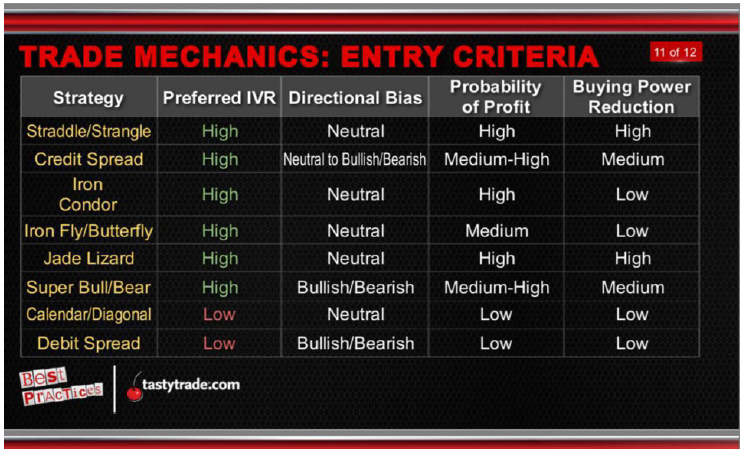

5. TRADE Log: VIX > 25

1.) Jade Lizards -

2.) Put Broken Wing Butterflies - TSLA*, GOOGL

3.) Put and Call Credit Spreads - IWM

4.) Put Calendars - BITO, F*, XHB, AMD*, PLTR*

6.) Upside Ghetto Spreads - TSLA, SAVA

7.) Downside Ghetto Spreads - SPY*

8.) Collars - F, PLTR

9.) Weekly Butterflies - SPX*

10.) Covered Calls - PDBC

6. Video and Articles

China Is About To Cause A Global Recession

https://youtu.be/pqvYUOTAp_o?t=386

https://theotrade.com/is-this-relentless-selling-only-the-beginning/

Keeping At IT | ITK with Cathie Wood

https://youtu.be/oe1BnQw2JnQ

https://traderschoice.net/about-traders-choice/

https://www.tastytrade.com/shows/market-measures/episodes/new-lookback-tutorial-07-15-2022

https://www.tastytrade.com/backtest

Tuesday 9:45am - DNOWS Meetup

Seabrook Discussion 7pm Wednesday

New Age Traders Noon Thursday

1. High Volatility: VIX > 25.

The Fed strikes Fear into the global markets.** Going forward, Bad Economic news is just bad news for the markets. Could we see a retest of the June lows before the midterm elections? Please keep your hedges on through the Midterm elections. The rise of both the US Dollar and Interest rates are hurting US Markets, Consumers and Businesses. The money printing machines are on full blast with the ECB buying Unlimited Bonds and the US $738 Billion Inflation Reduction Act. The new expected SPX range for this week: 4018 top and 3830 bottom.

Source: https://traderschoice.net/about-traders-choice/

2. US Dollar and 10 Year Interest Rate:

The US Dollar continues to rise near 110 with the EURO below US Dollar Parity. The 10Y Note Interest is above 3% and 30 year fixed rate mortgages are around 6-6.5%. The Yield curve for the 2year vs 10 year near 2000 levels. In the past, 2 negative GDP Quarters signaled a recession, but apparently this time is different?!?!? Long Term the US Dollar decline is still intact with Fiscal and Monetary stimulus flooding the world with US Dollars.

3. Crypto Currency:

Bitcoin is hovering around $20,000. Bitcoin has been range bound for 13 weeks between $18,500 and $24,000. Corporations, Countries, and Institutional investors are accumulating large Bitcoin positions. Please continue to Dollar Cost Average into Bitcoin and Ethereum. Crypto winter will last for another 10 months, as we wait for the next Bitcoin Halvening in 22 months. https://support.tastyworks.com/support/solutions/articles/43000612831-available-cryptocurrencies

4. Tasty Works Algo Trading System: James at Quiet Foundation

Alpha Boost ideas, sign up https://info.quietfoundation.com/alphaboost

https://issuu.com/luckbox/docs/2111-luckbox-site/56 Alph Boost Article

If you are new to options or this blog sounds like gibberish, please tryout Tasty Trade’s New 2020 Education. Includes 40 Videos, Testing and you get a certificate of completion at the end of the course.

https://tastytrade.thinkific.com/courses/beginner-options-course

5. TRADE Log: VIX > 25

1.) Jade Lizards -

2.) Put Broken Wing Butterflies - TSLA*, GOOGL

3.) Put and Call Credit Spreads - IWM

4.) Put Calendars - BITO, F*, XHB, AMD*, PLTR*

6.) Upside Ghetto Spreads - TSLA, SAVA

7.) Downside Ghetto Spreads - SPY*

8.) Collars - F, PLTR

9.) Weekly Butterflies - SPX*

10.) Covered Calls - PDBC

6. Video and Articles

China Is About To Cause A Global Recession

https://youtu.be/pqvYUOTAp_o?t=386

https://theotrade.com/is-this-relentless-selling-only-the-beginning/

Keeping At IT | ITK with Cathie Wood

https://youtu.be/oe1BnQw2JnQ

https://traderschoice.net/about-traders-choice/

https://www.tastytrade.com/shows/market-measures/episodes/new-lookback-tutorial-07-15-2022

https://www.tastytrade.com/backtest