Aug. 30, 2024 - Greetings! It’s been “a while” since I’ve posted, so I thought I’d take the time over this 3-day weekend.

I could have easily titled this as “So . . . Where Is The Risk?” But I didn’t want to sound too alarmist. But let’s use this time to ask the question: “Where is the (market) risk: at the top or at the bottom?” To many folks it’s not that obvious, but think about it. Markets correct or “crash” from market tops, and rally from market bottoms. The trick is to recognize when a trend has changed before the move is significant and obvious. So, the answer is, risk is greatest at the top (with 20/20 hindsight).

Right now, this market (via the S&P 500) is back to it’s all time high; a.k.a. “Top”. Has the ‘risk’ increased or decreased? Well, this market has priced in a fair amount of good news. Multiple interest rate cuts, a strong & growing economy and consumer strength. Earnings have been good and guidance fairly positive for future earnings. Sounds like Goldie Locks to me; a.k.a. the market is ‘priced to perfection’. That’s all well and good as long as things keep going in that direction and no one or no thing upsets this dynamic balance.

I want to emphasize that I’m NOT predicting gloom & doom, just caution. The easy money has been made already. Here are a couple of things to keep an eye on:

- The consumer is strong, but savings are not growing, but declining. Credit card debit is increasing, not decreasing. (slowing consumer demand?)

- Inflation is down, but prices remain high. This will take time to resolve.

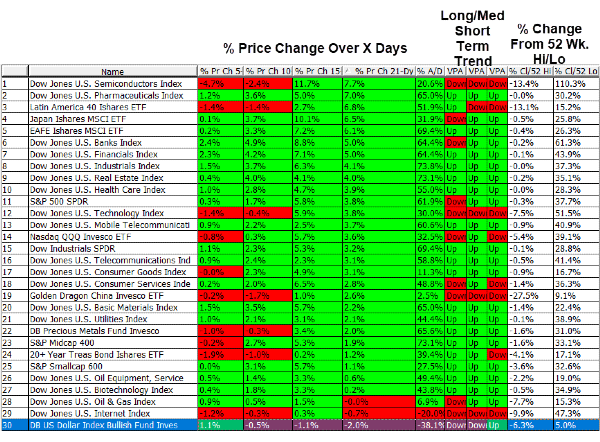

- Financials are strong with the anticipated rate cuts, but Technology is sluggish. (see chart)

All this sounds like a pause if things keep going “OK”, or a set up for a double top correction if things go a miss. A lot of folks are using leverage, and IF anything gets shaky, they will certainly reduce exposure. That’s for sure.

So, let’s be invested, but not over confident. “Nobody rings a bell at the market top”, it’s up to us.

For those in the USA, have a good holiday & Take Care. …………… Tom ……………….

Aug. 30, 2024 - Greetings! It’s been “a while” since I’ve posted, so I thought I’d take the time over this 3-day weekend.

I could have easily titled this as “So . . . Where Is The Risk?” But I didn’t want to sound too alarmist. But let’s use this time to ask the question: “Where is the (market) risk: at the top or at the bottom?” To many folks it’s not that obvious, but think about it. Markets correct or “crash” from market tops, and rally from market bottoms. The trick is to recognize when a trend has changed before the move is significant and obvious. So, the answer is, risk is greatest at the top (with 20/20 hindsight).

Right now, this market (via the S&P 500) is back to it’s all time high; a.k.a. “Top”. Has the ‘risk’ increased or decreased? Well, this market has priced in a fair amount of good news. Multiple interest rate cuts, a strong & growing economy and consumer strength. Earnings have been good and guidance fairly positive for future earnings. Sounds like Goldie Locks to me; a.k.a. the market is ‘priced to perfection’. That’s all well and good as long as things keep going in that direction and no one or no thing upsets this dynamic balance.

I want to emphasize that I’m NOT predicting gloom & doom, just caution. The easy money has been made already. Here are a couple of things to keep an eye on:

All this sounds like a pause if things keep going “OK”, or a set up for a double top correction if things go a miss. A lot of folks are using leverage, and IF anything gets shaky, they will certainly reduce exposure. That’s for sure.

So, let’s be invested, but not over confident. “Nobody rings a bell at the market top”, it’s up to us. For those in the USA, have a good holiday & Take Care. …………… Tom ……………….