Introduction

Building financial wealth is crucial for people as this will improve your financial wellbeing and financial freedom later on in your career. Potentially helping you to retire earlier, buy a house, save for education or whatever investment goal fits your profile. Fortunately, in modern society there are plenty of investment opportunities that you can exploit in order to help grow your money over time. Earning salary from your job is a great way to start building wealth but what if I told you that all the rich people earn the majority of their income from dividends, capital gains on investments, rent etc. In this article I will explain the most popular type of investment instruments that are on the market. Namely, stocks, bonds, real estate, ETFs and cryptocurrencies. Further, while investing can be relatively simple, it is important that you have a clear investment goal where you want to work towards to while also taking into consideration certain factors like investment horizon, risk tolerance and diversification. Combining all the knowledge and your personal preferences it is possible to make the right investment decisions for you.

Different type of investment instruments

Stocks

Starting of the with the most common investment instrument, stock. A stock represents a share of the company (Apple, Google, Ford, etc.) that gives you ownership and voting rights for the respected company. Stocks can be bought from many different companies around the world. With respect to the US, the largest US companies and stocks are traded on the New York Stock Exchange (NYSE) and National Association of Securities Dealers (NASDAQ).

The goal of owning a stock is that you (as an investor) want to be rewarded for bearing the risk of owning a share in that company. So what makes the stock increase or decrease in price. All the information that is publicly available should be reflected in the price of the stock. Some factors that influence a stock are their business model, environmental pollution, the ethics of the company, earnings season, geopolitical issues and much more. Generally, when a company is doing well by improving their revenues, profits or decreasing costs to improve gross profit margins, the price of the share is likely to go up. Hence, making a profit on your investment.

Shareholders can further be rewarded by earning dividends on their stock, this is a type of passive income as dividends are usually paid out quarterly, semi-annual or yearly. For a starting investor, it is recommended to hold your stock for a longer period as this will increases you possibility of making a positive return over time. One legendary quote that every investor should keep in mind is that “time in the market beats timing the market”.

Bonds

Bonds are less risky in comparison to stocks but also have a lower return (less risk, lower reward). So what is the main difference between the two. A bond is a debt instrument issued by the company in order to raise capital which they can use to invest in other assets, this is similar to equity (stock). However, the big difference is that the company is required to pay back the principal at maturity as well as paying a coupons/dividends every period. Hence, the investor is ensured that he/she will receive a coupon payment every period plus the principal amount at the end of the bonds lifespan. Because a bonds are considered to be debt for the company, the bondholders have payment priority over common stockholders. Meaning, if the company goes bankrupt, debtholders get paid back first with the remaining capital of the company and stockholders get what’s left on the table if there even is anything left.

Bonds can be bought from the state or from corporates. The major benefit of investing in treasury/government bonds is that they are risk-free. Implying that the government is too big to fail and therefore you are certain you will receive your coupon payments and principal back. Corporate bonds are a bit more risky as they bear the risk of the company going bankrupt. As a result, investors are rewarded with a higher coupon rate on those bonds. Noteworthy, is that bonds tend to become more attractive investments when interest rates in the market are high as this would mean that companies and governments are giving higher coupon rates on their bonds. To conclude, bonds are relatively safe investments but do have smaller returns in contrast to stocks. So if you are not a fan of bearing a lot of risk, bonds could be an interesting investment for you.

Real estate

Many people have the goal to sooner or later buy a house, either for themselves or as an investment. However, most of the times this requires a significant down payment and a large loan you have to pay off with interest over time. On the contrary, when you look at real estate as an investment opportunity it can be a very appealing market. Real estate tends to go up on the long turn due to growing market demand, lack of supply of real estate, inflation and strong economic conditions. On the other hand, when economic conditions are worsening due to higher interest rates, higher mortgage rates and increasing unemployment rates, the value of real estate might decrease. Hence, there are a lot of factors that influence the price of real estate.

The benefits of real estate are receiving rent and the appreciation in value of the property however the main con is that significant investments have to be made. Often including a mortgage on the house, mortgage rates are currently at record breaking highs in the last 2 decades, representing a rate between 6.5%-7%. With the current market conditions and these rates, it is very unattractive for retail investors to start investing in real estate. However, there are better alternatives if you want to invest in real estate without the need of large capital requirement. That’s why I like to introduce you to Real Estate Investment Trusts (REIT). Rather than buying your own real estate, you can invest in companies that own and operate in income producing real estate and that for a fraction of the price! Investors now have the opportunity to invest in real estate such as apartments, office buildings, hotels, warehouses and more. Hence, you can invest in all this real estate without any large capital requirements while still receiving the same benefits of receiving dividends as well as capital gains on your shares. One interesting aspect about REITs is that they tend to give higher dividend rates compared to other stocks and industries. More specifically, they offer higher dividend rates because they have to pay out 90% of its annual taxable income as dividends in order to receive their special tax considerations.

Figure 1: average 30 year mortgage rates in the US.

ETFs

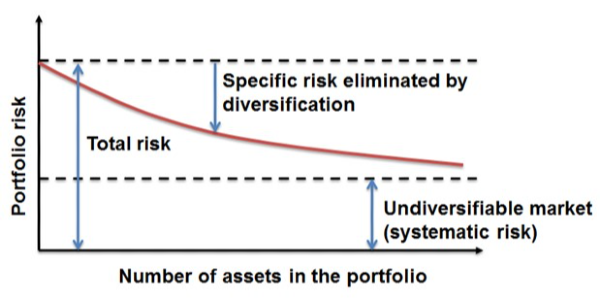

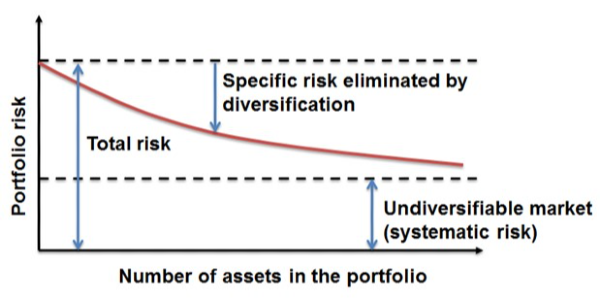

But what if you are not sure yet in what stocks you want to invest in, or maybe you even have a lot of companies in mind that you want to invest in. Then an Exchange Traded Funds (ETF) is the perfect solution for you. An ETF is a basket of companies that trades on the stock exchange like a normal share. Meaning you can buy and sell it everyday when the market is open. The biggest advantages of ETFs are that the costs tend to be much lower compared to buying and selling individual shares. Furthermore, investing in an passive ETF like the “SPY” (tracks the performance of the S&P500) helps you to diversify your portfolio and as a result, reduces your portfolio risk as can be seen in figure 2. Explicitly, investors want to earn the highest return possible for a given level of risk. For example, when it is possible to reduce your portfolio risk by investing in another assets while maintaining the same return, this is a very good deal because you now earn the same return while bearing less risk!

Figure 2: portfolio risk consists of diversifiable and undiversifiable risk

Thanks to the rapid growth in popularity in ETFs, there are now more than thousands of ETFs to invest in, some ETFs are very general and act as a benchmark while other ETFs might only invest in a very specific industry. Thanks to the variety of ETFs, all the different wants and needs of investors can be satisfied. For example, if you want to invest in a very broad index with many stocks, investing in an index ETF could be interesting. Alternatively, if you value environment, social and governance aspects in companies, investing in an ESG ETF might be the way to go. To further specify, as mentioned earlier there are passive ETFs which generally track the performance of an index or market. Just like the “SPY” which follows the stocks and performance of the S&P500. In contrast, there are actively managed ETFs where portfolio managers have the ability to buy or sell shares to adapt the ETFs to future market conditions and trends. Hence, ETF investing is a very easy and simple way to start investing with many benefits. Thanks to ETFs you are likely to have a diversified investment portfolio across industries unless you buy an ETF for one specific industry. But also here you diversify your shares within that industry. Furthermore, costs or the expense ratio of ETFs tend to be very low making it attractive for retail investors.

Cryptocurrencies

Of course we cannot leave out investing in cryptocurrencies as this is the most upcoming investment trend in the last decade thanks to its growth potential and technological innovation. However, do note that this is still a very speculative market which brings a lot of risk. Crypto is known for their incredible volatility, lack of regulations, market sentiment and social media hype. But what are cryptocurrencies? Crypto is a digital and decentralized currency that operates on the blockchain. The beauty of the blockchain is it is essentially a very safe way to save new transaction on the blockchain where it is impossible to change one entry in the blockchain without altering the whole chain of blocks. Another unique characteristic of crypto is the decentralization, meaning that there is no centralized power that controls the systems but rather a distributed network of many peers. This can ultimately help to reduce the level of trust that is required by participants since there is no single point of failure. Hence, the main benefit of blockchain is that it ensures the security, authenticity and transparency of transaction made on the blockchain. Next, let’s take a look at the two most well-known cryptos which are Bitcoin and Ethereum.

Bitcoin is digital currency traded and recorded by a peer to peer network on a blockchain and works on a Proof of Work (PoW) basis. First of all, Bitcoin is decentralized so there is not a central entity that could influence or alter any of the blocks within the blockchain but rather the peer to peer network is there to make sure all transactions are successfully verified and recorded on the blockchain. Validating transactions and creating new blocks can also be referred to as “mining”. This goes as follows: When a Bitcoin transaction is made by a random person, the transaction must be validated by other peers in the network, once this is done the validators/miners are trying to solve a complex puzzle in order to be the first one to create a new block that could be attached to the existing blockchain. If done successfully, the miner will be rewarded by the system and hence receives Bitcoins as a payment. Another unique characteristic of Bitcoin is that is has a limited supply of 21 million and 19 million have already been mined. However, because the reward/mining system halves every 4 years (bitcoin halving) this creates a type of scarcity which is similar to commodities like gold. Potentially boosting the price in the future since the supply is fixed and demand could continue to grow. Finally, Bitcoin is known for its transparency and anonymity. Because the blockchain is online, everybody is able to see who is making transaction and to what address they are sending Bitcoins. However, the accounts or wallet addresses consist of a very long name with random numbers and letters, making it anonymous since you do not see any personal information. To conclude, while Bitcoin has a lot of potential it remains a very risky investment due to its infancy and lack of regulations. But a high risk could mean a high reward!

In contrast, Ethereum is a decentralized, open source blockchain with smart contract functionality and works on a Proof of Stake (PoS) basis. Ethereum can also be seen as a platform for other cryptos and decentralized apps (Dapps) to be built on by fellow engineers. Building Dapps on the network or running smart contracts requires “gas” which reflects the amount of computational effort that is required to execute a certain action. The gas fee has to be paid with Ether, the native coin of Ethereum. So we know that smart contracts are crucial for the operations on the Ethereum network but what is it specifically. Smart contracts are just like real contracts indicating that it is a set of promises specified in digital form including protocols. Hence, when all the conditions from a contract are met, a new transaction or protocol is activated based on the code and the output of contract. Furthermore, Dapps are increasing in popularity and take all different types of forms. For example, decentralized finance (DeFI) are financial platforms that operate on smart contracts and are governed by the token owners. Another example is that you can create games on the Ethereum network where players can be rewarded with special tokens or items in game. To conclude, Ethereum is much more than just a transactional system like Bitcoin, it gives people to opportunity to build Dapps on the platform and turn the platform into a use case for various activities (finances, games, decentralized exchanges etc.)

How to set your personal investment goal

Now that you have a general idea of what the various investment instruments look like, it is time to think about your personal investment goals. Having a clear objective in mind will help you focus on achieving your goals as well as making more accurate investment decisions that are aligned with your goals and risk tolerance. Starting of with setting your financial goal, this is personal for everyone and could be anything. Some people are saving for their retirement, others want to save money for the education of their child or maybe you are saving up for a down payment for a house.

Let’s say we want to save for our retirement as our financial goal. Before we start investing in different assets, there are some factors we have to take into consideration that could help us make better investment decisions. First, what is your personal risk tolerance? Older people tend to be a bit more risk averse since they are closer to their retirement age and hence do not want to take the risk of losing their money at this moment in time. On the other hand, young adults still have a very long investment horizon so they have the possibility to invest a little bit more risky in order to get larger returns over time, at least if your personal risk tolerance tolerates it. Never invest in something you are not comfortable with. In the worst case scenario, your stocks or other investments lose money in one year. However, if you remain calm and invested in the market there is a large possibility your investments will recover and experience gains in the future. As we see, although the investment goal is the same, we need very different investment strategies for both parties.

Market conditions and the macro-economic factors such as interest rates and inflation also play a key role when you want to start investing. When we look at 2024 for example, we see that interest rates are very high as a result of high inflation in 2022-2023. This also puts more pressure on the economy since raising capital for both institutions and individuals now becomes more costly. This can also be seen back in stock returns, companies are required to make revenue in order to continue growing their profits because the costs of their daily operations are increasing. Hence, investors are bearing more risk and want to be rewarded for it. On the other side, bonds are now becoming more attractive investments due to increasing interest rates. New bonds are issued with higher coupon rates in order to attract investors. Meaning investors can earn higher (semi)annual coupon payments throughout the lifespan of the bond. Therefore, investors should always stay up to date with the latest market trends and market conditions in order to make adjustments to their portfolio and improve their return while minimizing risk.

Finally, for every investor it is important to have a diversified portfolio since you do not want to put all your eggs in one basket. While this can give you higher returns in an upside trending market, when markets turn south you can also incur heavy losses. That is why you want to invest in various assets and industries. Doing this helps you manage your portfolio risk and reduce the significant impact a stock has on your portfolio returns. In general, many portfolios consist of bonds and stocks from different industries such as tech, financial services, consumer goods, utilities etc.

Conclusion

Starting to invest can be scary since you have to put your money to work rather than keep it in your savings account where it is earning minimal interest. However, it does bring great benefits as over time you are very likely to earn returns which are significantly larger then you would have earned on your savings account. We explored a variety of investment instrument from the most common ones like stocks, bonds and ETFs to more comprehensive instruments like REITs and cryptocurrencies. Each of the assets has its own pros and cons so it is crucial to align your financial goals, risk tolerance and investment horizon with the investments you make.

Furthermore, always make sure to diversify your portfolio as this will reduce portfolio risk and reduce the chance that you incur large losses in your portfolio from one assets that drastically underperforms the market. If you do not feel confident about creating your own diversified portfolio with a combination of stocks and bonds, I strongly recommend you to take a look at passive ETFs. ETFs are often strongly diversified assets, one perfect example is the “SPY” which tracks the stocks and performance of the S&P500. Hence, you now invest in the 500 largest companies in the US from various industries. Hence, you create a diversified portfolio by only buying 1 investment instrument!

No matter what your ultimate investment goal is, the principles of thoughtful investing remain the same. Stick to your strategy, stay committed, make adjustments when necessary and continue to learn from your mistakes. Dive in to the world of investing with confidence, and remember, the best time to start investing is NOW.

Introduction

Building financial wealth is crucial for people as this will improve your financial wellbeing and financial freedom later on in your career. Potentially helping you to retire earlier, buy a house, save for education or whatever investment goal fits your profile. Fortunately, in modern society there are plenty of investment opportunities that you can exploit in order to help grow your money over time. Earning salary from your job is a great way to start building wealth but what if I told you that all the rich people earn the majority of their income from dividends, capital gains on investments, rent etc. In this article I will explain the most popular type of investment instruments that are on the market. Namely, stocks, bonds, real estate, ETFs and cryptocurrencies. Further, while investing can be relatively simple, it is important that you have a clear investment goal where you want to work towards to while also taking into consideration certain factors like investment horizon, risk tolerance and diversification. Combining all the knowledge and your personal preferences it is possible to make the right investment decisions for you.

Different type of investment instruments

Stocks

Starting of the with the most common investment instrument, stock. A stock represents a share of the company (Apple, Google, Ford, etc.) that gives you ownership and voting rights for the respected company. Stocks can be bought from many different companies around the world. With respect to the US, the largest US companies and stocks are traded on the New York Stock Exchange (NYSE) and National Association of Securities Dealers (NASDAQ).

The goal of owning a stock is that you (as an investor) want to be rewarded for bearing the risk of owning a share in that company. So what makes the stock increase or decrease in price. All the information that is publicly available should be reflected in the price of the stock. Some factors that influence a stock are their business model, environmental pollution, the ethics of the company, earnings season, geopolitical issues and much more. Generally, when a company is doing well by improving their revenues, profits or decreasing costs to improve gross profit margins, the price of the share is likely to go up. Hence, making a profit on your investment.

Shareholders can further be rewarded by earning dividends on their stock, this is a type of passive income as dividends are usually paid out quarterly, semi-annual or yearly. For a starting investor, it is recommended to hold your stock for a longer period as this will increases you possibility of making a positive return over time. One legendary quote that every investor should keep in mind is that “time in the market beats timing the market”.

Bonds

Bonds are less risky in comparison to stocks but also have a lower return (less risk, lower reward). So what is the main difference between the two. A bond is a debt instrument issued by the company in order to raise capital which they can use to invest in other assets, this is similar to equity (stock). However, the big difference is that the company is required to pay back the principal at maturity as well as paying a coupons/dividends every period. Hence, the investor is ensured that he/she will receive a coupon payment every period plus the principal amount at the end of the bonds lifespan. Because a bonds are considered to be debt for the company, the bondholders have payment priority over common stockholders. Meaning, if the company goes bankrupt, debtholders get paid back first with the remaining capital of the company and stockholders get what’s left on the table if there even is anything left.

Bonds can be bought from the state or from corporates. The major benefit of investing in treasury/government bonds is that they are risk-free. Implying that the government is too big to fail and therefore you are certain you will receive your coupon payments and principal back. Corporate bonds are a bit more risky as they bear the risk of the company going bankrupt. As a result, investors are rewarded with a higher coupon rate on those bonds. Noteworthy, is that bonds tend to become more attractive investments when interest rates in the market are high as this would mean that companies and governments are giving higher coupon rates on their bonds. To conclude, bonds are relatively safe investments but do have smaller returns in contrast to stocks. So if you are not a fan of bearing a lot of risk, bonds could be an interesting investment for you.

Real estate

Many people have the goal to sooner or later buy a house, either for themselves or as an investment. However, most of the times this requires a significant down payment and a large loan you have to pay off with interest over time. On the contrary, when you look at real estate as an investment opportunity it can be a very appealing market. Real estate tends to go up on the long turn due to growing market demand, lack of supply of real estate, inflation and strong economic conditions. On the other hand, when economic conditions are worsening due to higher interest rates, higher mortgage rates and increasing unemployment rates, the value of real estate might decrease. Hence, there are a lot of factors that influence the price of real estate.

The benefits of real estate are receiving rent and the appreciation in value of the property however the main con is that significant investments have to be made. Often including a mortgage on the house, mortgage rates are currently at record breaking highs in the last 2 decades, representing a rate between 6.5%-7%. With the current market conditions and these rates, it is very unattractive for retail investors to start investing in real estate. However, there are better alternatives if you want to invest in real estate without the need of large capital requirement. That’s why I like to introduce you to Real Estate Investment Trusts (REIT). Rather than buying your own real estate, you can invest in companies that own and operate in income producing real estate and that for a fraction of the price! Investors now have the opportunity to invest in real estate such as apartments, office buildings, hotels, warehouses and more. Hence, you can invest in all this real estate without any large capital requirements while still receiving the same benefits of receiving dividends as well as capital gains on your shares. One interesting aspect about REITs is that they tend to give higher dividend rates compared to other stocks and industries. More specifically, they offer higher dividend rates because they have to pay out 90% of its annual taxable income as dividends in order to receive their special tax considerations.

Figure 1: average 30 year mortgage rates in the US.

ETFs

But what if you are not sure yet in what stocks you want to invest in, or maybe you even have a lot of companies in mind that you want to invest in. Then an Exchange Traded Funds (ETF) is the perfect solution for you. An ETF is a basket of companies that trades on the stock exchange like a normal share. Meaning you can buy and sell it everyday when the market is open. The biggest advantages of ETFs are that the costs tend to be much lower compared to buying and selling individual shares. Furthermore, investing in an passive ETF like the “SPY” (tracks the performance of the S&P500) helps you to diversify your portfolio and as a result, reduces your portfolio risk as can be seen in figure 2. Explicitly, investors want to earn the highest return possible for a given level of risk. For example, when it is possible to reduce your portfolio risk by investing in another assets while maintaining the same return, this is a very good deal because you now earn the same return while bearing less risk!

Figure 2: portfolio risk consists of diversifiable and undiversifiable risk

Thanks to the rapid growth in popularity in ETFs, there are now more than thousands of ETFs to invest in, some ETFs are very general and act as a benchmark while other ETFs might only invest in a very specific industry. Thanks to the variety of ETFs, all the different wants and needs of investors can be satisfied. For example, if you want to invest in a very broad index with many stocks, investing in an index ETF could be interesting. Alternatively, if you value environment, social and governance aspects in companies, investing in an ESG ETF might be the way to go. To further specify, as mentioned earlier there are passive ETFs which generally track the performance of an index or market. Just like the “SPY” which follows the stocks and performance of the S&P500. In contrast, there are actively managed ETFs where portfolio managers have the ability to buy or sell shares to adapt the ETFs to future market conditions and trends. Hence, ETF investing is a very easy and simple way to start investing with many benefits. Thanks to ETFs you are likely to have a diversified investment portfolio across industries unless you buy an ETF for one specific industry. But also here you diversify your shares within that industry. Furthermore, costs or the expense ratio of ETFs tend to be very low making it attractive for retail investors.

Cryptocurrencies

Of course we cannot leave out investing in cryptocurrencies as this is the most upcoming investment trend in the last decade thanks to its growth potential and technological innovation. However, do note that this is still a very speculative market which brings a lot of risk. Crypto is known for their incredible volatility, lack of regulations, market sentiment and social media hype. But what are cryptocurrencies? Crypto is a digital and decentralized currency that operates on the blockchain. The beauty of the blockchain is it is essentially a very safe way to save new transaction on the blockchain where it is impossible to change one entry in the blockchain without altering the whole chain of blocks. Another unique characteristic of crypto is the decentralization, meaning that there is no centralized power that controls the systems but rather a distributed network of many peers. This can ultimately help to reduce the level of trust that is required by participants since there is no single point of failure. Hence, the main benefit of blockchain is that it ensures the security, authenticity and transparency of transaction made on the blockchain. Next, let’s take a look at the two most well-known cryptos which are Bitcoin and Ethereum.

Bitcoin is digital currency traded and recorded by a peer to peer network on a blockchain and works on a Proof of Work (PoW) basis. First of all, Bitcoin is decentralized so there is not a central entity that could influence or alter any of the blocks within the blockchain but rather the peer to peer network is there to make sure all transactions are successfully verified and recorded on the blockchain. Validating transactions and creating new blocks can also be referred to as “mining”. This goes as follows: When a Bitcoin transaction is made by a random person, the transaction must be validated by other peers in the network, once this is done the validators/miners are trying to solve a complex puzzle in order to be the first one to create a new block that could be attached to the existing blockchain. If done successfully, the miner will be rewarded by the system and hence receives Bitcoins as a payment. Another unique characteristic of Bitcoin is that is has a limited supply of 21 million and 19 million have already been mined. However, because the reward/mining system halves every 4 years (bitcoin halving) this creates a type of scarcity which is similar to commodities like gold. Potentially boosting the price in the future since the supply is fixed and demand could continue to grow. Finally, Bitcoin is known for its transparency and anonymity. Because the blockchain is online, everybody is able to see who is making transaction and to what address they are sending Bitcoins. However, the accounts or wallet addresses consist of a very long name with random numbers and letters, making it anonymous since you do not see any personal information. To conclude, while Bitcoin has a lot of potential it remains a very risky investment due to its infancy and lack of regulations. But a high risk could mean a high reward!

In contrast, Ethereum is a decentralized, open source blockchain with smart contract functionality and works on a Proof of Stake (PoS) basis. Ethereum can also be seen as a platform for other cryptos and decentralized apps (Dapps) to be built on by fellow engineers. Building Dapps on the network or running smart contracts requires “gas” which reflects the amount of computational effort that is required to execute a certain action. The gas fee has to be paid with Ether, the native coin of Ethereum. So we know that smart contracts are crucial for the operations on the Ethereum network but what is it specifically. Smart contracts are just like real contracts indicating that it is a set of promises specified in digital form including protocols. Hence, when all the conditions from a contract are met, a new transaction or protocol is activated based on the code and the output of contract. Furthermore, Dapps are increasing in popularity and take all different types of forms. For example, decentralized finance (DeFI) are financial platforms that operate on smart contracts and are governed by the token owners. Another example is that you can create games on the Ethereum network where players can be rewarded with special tokens or items in game. To conclude, Ethereum is much more than just a transactional system like Bitcoin, it gives people to opportunity to build Dapps on the platform and turn the platform into a use case for various activities (finances, games, decentralized exchanges etc.)

How to set your personal investment goal

Now that you have a general idea of what the various investment instruments look like, it is time to think about your personal investment goals. Having a clear objective in mind will help you focus on achieving your goals as well as making more accurate investment decisions that are aligned with your goals and risk tolerance. Starting of with setting your financial goal, this is personal for everyone and could be anything. Some people are saving for their retirement, others want to save money for the education of their child or maybe you are saving up for a down payment for a house.

Let’s say we want to save for our retirement as our financial goal. Before we start investing in different assets, there are some factors we have to take into consideration that could help us make better investment decisions. First, what is your personal risk tolerance? Older people tend to be a bit more risk averse since they are closer to their retirement age and hence do not want to take the risk of losing their money at this moment in time. On the other hand, young adults still have a very long investment horizon so they have the possibility to invest a little bit more risky in order to get larger returns over time, at least if your personal risk tolerance tolerates it. Never invest in something you are not comfortable with. In the worst case scenario, your stocks or other investments lose money in one year. However, if you remain calm and invested in the market there is a large possibility your investments will recover and experience gains in the future. As we see, although the investment goal is the same, we need very different investment strategies for both parties.

Market conditions and the macro-economic factors such as interest rates and inflation also play a key role when you want to start investing. When we look at 2024 for example, we see that interest rates are very high as a result of high inflation in 2022-2023. This also puts more pressure on the economy since raising capital for both institutions and individuals now becomes more costly. This can also be seen back in stock returns, companies are required to make revenue in order to continue growing their profits because the costs of their daily operations are increasing. Hence, investors are bearing more risk and want to be rewarded for it. On the other side, bonds are now becoming more attractive investments due to increasing interest rates. New bonds are issued with higher coupon rates in order to attract investors. Meaning investors can earn higher (semi)annual coupon payments throughout the lifespan of the bond. Therefore, investors should always stay up to date with the latest market trends and market conditions in order to make adjustments to their portfolio and improve their return while minimizing risk.

Finally, for every investor it is important to have a diversified portfolio since you do not want to put all your eggs in one basket. While this can give you higher returns in an upside trending market, when markets turn south you can also incur heavy losses. That is why you want to invest in various assets and industries. Doing this helps you manage your portfolio risk and reduce the significant impact a stock has on your portfolio returns. In general, many portfolios consist of bonds and stocks from different industries such as tech, financial services, consumer goods, utilities etc.

Conclusion

Starting to invest can be scary since you have to put your money to work rather than keep it in your savings account where it is earning minimal interest. However, it does bring great benefits as over time you are very likely to earn returns which are significantly larger then you would have earned on your savings account. We explored a variety of investment instrument from the most common ones like stocks, bonds and ETFs to more comprehensive instruments like REITs and cryptocurrencies. Each of the assets has its own pros and cons so it is crucial to align your financial goals, risk tolerance and investment horizon with the investments you make.

Furthermore, always make sure to diversify your portfolio as this will reduce portfolio risk and reduce the chance that you incur large losses in your portfolio from one assets that drastically underperforms the market. If you do not feel confident about creating your own diversified portfolio with a combination of stocks and bonds, I strongly recommend you to take a look at passive ETFs. ETFs are often strongly diversified assets, one perfect example is the “SPY” which tracks the stocks and performance of the S&P500. Hence, you now invest in the 500 largest companies in the US from various industries. Hence, you create a diversified portfolio by only buying 1 investment instrument!

No matter what your ultimate investment goal is, the principles of thoughtful investing remain the same. Stick to your strategy, stay committed, make adjustments when necessary and continue to learn from your mistakes. Dive in to the world of investing with confidence, and remember, the best time to start investing is NOW.