Cover Image by David Z

Is UNP a Buy?

Union Pacific is not a buy to start off 2024. Union Pacific is a fine business. There are issues but nothing that is significant enough to believe the company’s intrinsic value will shrink in the next decade. The company will likely continue to grow and expand their market and solidify their oligopoly on railroad services in the Southwest region.

The problem is simple: the stock is overvalued. The stock is so overvalued that you almost want to buy a put option on Union Pacific. The market has focused too much on moat and forgot that Union Pacific can only grow so fast. The company’s current price is exorbitantly overvalued compared to its reasonable intrinsic value.

Is Union Pacific Overvalued?

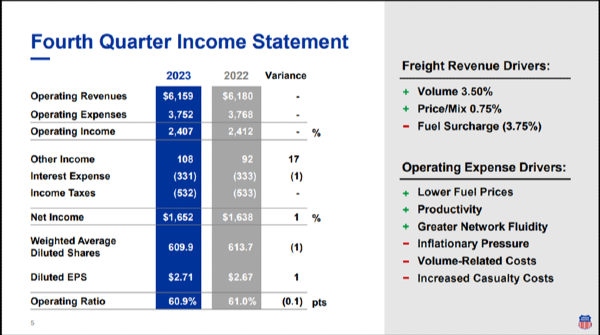

Sometimes the market just wants to hold a stock that is a good company regardless of its overvaluation. Union Pacific’s growth is flat with no changes between Q4 2022 and Q4 2023.

Operating revenues were flat. Operating expenses are also flat. And earnings per share were effectively flat.

Over the full year, the story is the same. Revenue was flat at around $6 billion. Diluted EPS year-over-year was flat. For a railroad company, its cargo may be moving but its stock is going nowhere.

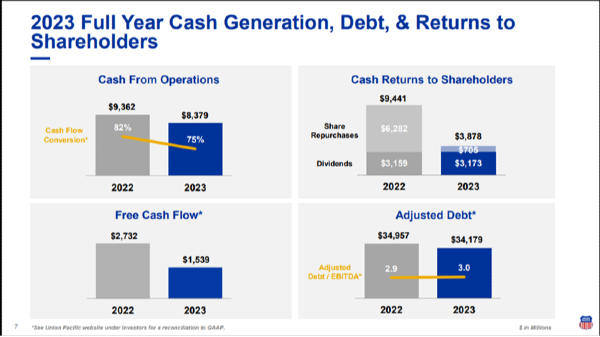

What’s alarming was that cash generated from operations fell year-over-year as well. And “cash returned to shareholders” fell significantly from $9 Billion to $4 Billion. To be fair to the executive management at Union Pacific, dividends did grow while the company dropped their share repurchase program.

As we’ll see, stopping the repurchase program is likely a great decision by management. Though share repurchases help grow shareholder value, that rule of thumb goes out the door if you’re buying a stock that is significantly overvalued.

Union Pacific Stock Outlook

This theme of “flatness” continues into Union Pacific’s 2024 outlook.

Union Pacific is greatly affected by the overall economy. The company has done a terrific job diversifying the freight moved by the railroad; however, if the overall economy is sluggish, then the total amount of cargo delivered by the railroad will fall regardless of which their volume mix. Union Pacific’s own Economic forecast is described as “muted” for 2024, and this translates to muted growth in cargo sales across multiple industries.

While fertilizer, petroleum, and automotive parts could see an uptick in 2024, coal and construction are looking to fall in transportation demand.

In more positive news, Union Pacific was able to increase all their year-over-year change metrics. This is a good sign that the executive team is managing what they can control by improving operations. Freight car velocity over Q4 2023 increased, while on time delivery also increased. These metrics can only be improved via better planning and upkeep of their network. This is a good sign that costs and revenue throughput are being maintained.

These metrics look to have made an impact on the company’s operating ratio with a slight improvement quarter-over-quarter. This may be why earnings per share increased year-over-year (albeit slightly) while revenue fell.

What has Union Pacific Invested in?

Overall, Union Pacific has gone through multiple mergers across the U.S. west, Canada, and Mexico. They have a robust network of rails and terminals across these regions.

Union Pacific plans to invest around 15% of revenue into capital programs in 2024. This has stayed steady in the last three years with about half of this capital invested in growth initiatives while the rest is for repair, maintenance, and renewal.

In the Union Pacific pitch book, the expansion is taking place in various growth regions across the U.S. and Mexico. Strong growth in plastics has fueled capital expenditure in Texas and Louisiana with $220 Billion in investments already completed in the arena.

Expansions are also occurring in highly active Economic areas like the Twin cities metropolitan area and the Inland Empire metropolitan area east of Los Angeles.

Logistical Expansion

Union Pacific has also been investing heavily in smarter logistics. The creation of Loup Logistics was a result of a merger of four subsidiaries that are now wholly owned by Union Pacific.

Since then, Loup logistics has acquired facilities of their own with one of the biggest being the Phoenix Transload facility in 2022.

UNP Stock Forecast

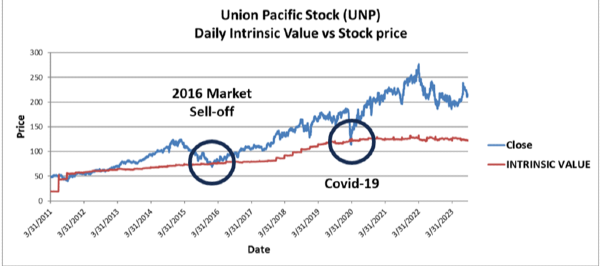

Union pacific is likely to continue its linear growth through 2025. Union Pacific is currently significantly overvalued. We speculate that the high ownership of institutional investors is overvaluing the stock along with the company’s coupling with the overall economy.

Currently, 82.13% of shares are held by institutional investors. Hence, when the market starts to fall rapidly, this may be the reason why Union Pacific’s stock price will fall and touch its intrinsic value. Once the intrinsic value is reached, value investors jumping in and grab the stock at its fair value.

The stock has fallen back to its intrinsic value twice since the market de-coupled the price from its intrinsic value back in 2013. The first time the stock fell back to UNP’s intrinsic value was during the 2016 market sell-off. The second time UNP fell back to its intrinsic value was during the Covid-19 pandemic.

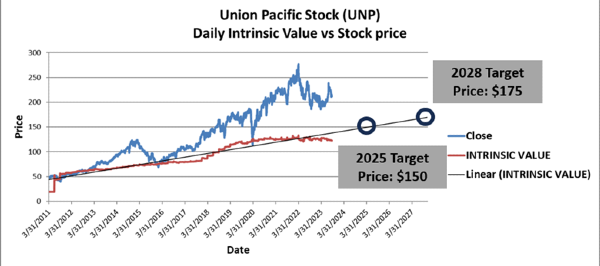

UNP is considered a buy if its stock price is pushed down below $150, or back near its intrinsic value, assuming that the fall is due to the overall market falling and not something specific with Union Pacific.

Union Pacific (UNP) 2-year Forecast for 2025

Union Pacific will likely continue staying in the $200 to $300 range through 2025; however, the buying opportunity would occur if UNP fell to its intrinsic value of $150.

Union Pacific is buoyed by institutional investors. The stock has a regular dividend, it is consistent and relatively predictable, and fund managers aren’t penalized for overvaluing a “common sense” stock like Union Pacific. These reasons are likely why institutional investors hold UNP. Take advantage of this fact by buying the stock if it flash-crashes back down to its intrinsic value.

Union Pacific (UNP) 5-year Forecast for 2028

Union Pacific has a price target of $175 going into 2028. The stock will likely underperform the overall market in price appreciation due to its steady and growing dividend that erodes its intrinsic value. This isn’t a cause to avoid Union Pacific; the stock is a good choice as a safe stock with a growing dividend.

The stock could potentially underperform this target if growth doesn’t kick back up. In the latest year-over-year results, the company did perform better with a higher EPS result and lower costs. If the executive team can keep focus on cost reductions and transportation expansion, intrinsic value may start to rise and end the price stagnation that has plagued UNP since 2022.

Union Pacific Dividend

Union Pacific has grown its dividend consistently since 2014 when it dropped the dividend slightly. The growth has been in line with its earnings, meaning the board of directors are maintaining a reasonable dividend payout ratio.

For dividend investors, UNP is a reasonable choice for steady dividend income. The stock is relatively stable, even if it’s inflated. A dollar-cost averaging strategy can offset the effects of the stock’s inflated cost.

Further Resources

Cover Image by David Z

Is UNP a Buy?

Union Pacific is not a buy to start off 2024. Union Pacific is a fine business. There are issues but nothing that is significant enough to believe the company’s intrinsic value will shrink in the next decade. The company will likely continue to grow and expand their market and solidify their oligopoly on railroad services in the Southwest region. The problem is simple: the stock is overvalued. The stock is so overvalued that you almost want to buy a put option on Union Pacific. The market has focused too much on moat and forgot that Union Pacific can only grow so fast. The company’s current price is exorbitantly overvalued compared to its reasonable intrinsic value.

Is Union Pacific Overvalued?

Sometimes the market just wants to hold a stock that is a good company regardless of its overvaluation. Union Pacific’s growth is flat with no changes between Q4 2022 and Q4 2023.

Operating revenues were flat. Operating expenses are also flat. And earnings per share were effectively flat.

Union Pacific Q4 2023 earnings presentation, page 5

Over the full year, the story is the same. Revenue was flat at around $6 billion. Diluted EPS year-over-year was flat. For a railroad company, its cargo may be moving but its stock is going nowhere.

What’s alarming was that cash generated from operations fell year-over-year as well. And “cash returned to shareholders” fell significantly from $9 Billion to $4 Billion. To be fair to the executive management at Union Pacific, dividends did grow while the company dropped their share repurchase program.

As we’ll see, stopping the repurchase program is likely a great decision by management. Though share repurchases help grow shareholder value, that rule of thumb goes out the door if you’re buying a stock that is significantly overvalued.

Union Pacific Q4 2023 earnings presentation, page 7

Union Pacific Stock Outlook

This theme of “flatness” continues into Union Pacific’s 2024 outlook.

Union Pacific is greatly affected by the overall economy. The company has done a terrific job diversifying the freight moved by the railroad; however, if the overall economy is sluggish, then the total amount of cargo delivered by the railroad will fall regardless of which their volume mix. Union Pacific’s own Economic forecast is described as “muted” for 2024, and this translates to muted growth in cargo sales across multiple industries.

Union Pacific Q4 2023 earnings presentation, page 11

While fertilizer, petroleum, and automotive parts could see an uptick in 2024, coal and construction are looking to fall in transportation demand.

In more positive news, Union Pacific was able to increase all their year-over-year change metrics. This is a good sign that the executive team is managing what they can control by improving operations. Freight car velocity over Q4 2023 increased, while on time delivery also increased. These metrics can only be improved via better planning and upkeep of their network. This is a good sign that costs and revenue throughput are being maintained.

These metrics look to have made an impact on the company’s operating ratio with a slight improvement quarter-over-quarter. This may be why earnings per share increased year-over-year (albeit slightly) while revenue fell.

What has Union Pacific Invested in?

Overall, Union Pacific has gone through multiple mergers across the U.S. west, Canada, and Mexico. They have a robust network of rails and terminals across these regions.

Union Pacific plans to invest around 15% of revenue into capital programs in 2024. This has stayed steady in the last three years with about half of this capital invested in growth initiatives while the rest is for repair, maintenance, and renewal.

Union Pacific Q4 2023 earnings presentation, page 15

In the Union Pacific pitch book, the expansion is taking place in various growth regions across the U.S. and Mexico. Strong growth in plastics has fueled capital expenditure in Texas and Louisiana with $220 Billion in investments already completed in the arena.

Expansions are also occurring in highly active Economic areas like the Twin cities metropolitan area and the Inland Empire metropolitan area east of Los Angeles.

Logistical Expansion

Union Pacific has also been investing heavily in smarter logistics. The creation of Loup Logistics was a result of a merger of four subsidiaries that are now wholly owned by Union Pacific.

Since then, Loup logistics has acquired facilities of their own with one of the biggest being the Phoenix Transload facility in 2022.

UNP Stock Forecast

Union pacific is likely to continue its linear growth through 2025. Union Pacific is currently significantly overvalued. We speculate that the high ownership of institutional investors is overvaluing the stock along with the company’s coupling with the overall economy.

Currently, 82.13% of shares are held by institutional investors. Hence, when the market starts to fall rapidly, this may be the reason why Union Pacific’s stock price will fall and touch its intrinsic value. Once the intrinsic value is reached, value investors jumping in and grab the stock at its fair value.

The stock has fallen back to its intrinsic value twice since the market de-coupled the price from its intrinsic value back in 2013. The first time the stock fell back to UNP’s intrinsic value was during the 2016 market sell-off. The second time UNP fell back to its intrinsic value was during the Covid-19 pandemic.

UNP is considered a buy if its stock price is pushed down below $150, or back near its intrinsic value, assuming that the fall is due to the overall market falling and not something specific with Union Pacific.

Union Pacific (UNP) 2-year Forecast for 2025

Union Pacific will likely continue staying in the $200 to $300 range through 2025; however, the buying opportunity would occur if UNP fell to its intrinsic value of $150.

Union Pacific is buoyed by institutional investors. The stock has a regular dividend, it is consistent and relatively predictable, and fund managers aren’t penalized for overvaluing a “common sense” stock like Union Pacific. These reasons are likely why institutional investors hold UNP. Take advantage of this fact by buying the stock if it flash-crashes back down to its intrinsic value.

Union Pacific (UNP) 5-year Forecast for 2028

Union Pacific has a price target of $175 going into 2028. The stock will likely underperform the overall market in price appreciation due to its steady and growing dividend that erodes its intrinsic value. This isn’t a cause to avoid Union Pacific; the stock is a good choice as a safe stock with a growing dividend.

The stock could potentially underperform this target if growth doesn’t kick back up. In the latest year-over-year results, the company did perform better with a higher EPS result and lower costs. If the executive team can keep focus on cost reductions and transportation expansion, intrinsic value may start to rise and end the price stagnation that has plagued UNP since 2022.

Union Pacific Dividend

Union Pacific has grown its dividend consistently since 2014 when it dropped the dividend slightly. The growth has been in line with its earnings, meaning the board of directors are maintaining a reasonable dividend payout ratio.

For dividend investors, UNP is a reasonable choice for steady dividend income. The stock is relatively stable, even if it’s inflated. A dollar-cost averaging strategy can offset the effects of the stock’s inflated cost.

Further Resources

I/we have no positions in any asset mentioned, and no plans to initiate any positions for the next 7 days