Consolidated Edison, Inc. (ED) is a company that helps people get electricity and natural gas in the New York City area. They have different things that they do to provide these services. This article talks about how the company works, what it is good at, and how it does with the money. And how it takes care of the environment and the people who live in the area.

Business Model of Consolidated Edison, Inc. (ED)

ED is a company that provides energy-related things to people in New York City. It has some smaller companies that help it do this. The government tells ED how much money it can charge people for its services. This helps the company make enough money to keep doing its job well and make sure people get what they need.

ED gets money by selling electricity and natural gas to different kinds of customers like homes, stores, and factories. They also have a smaller company called Con Edison Solutions that helps people with energy things in other parts of the country. The company also tries to help the environment by investing in things like renewable energy and ways to use less energy.

SWOT Analysis of Consolidated Edison, Inc. (ED)

SWOT analysis is a strategic planning tool that evaluates the Strengths, Weaknesses, Opportunities, and Threats of an organization. Here is a SWOT analysis for Consolidated Edison, Inc. (ED):

Strengths:

Weaknesses:

Opportunities:

- Growing demand for renewable energy

- Mergers and acquisitions

- Increase in energy efficiency

Threats:

- Competition

- Fluctuations in energy prices

- Environmental regulations

Earning Report of Consolidated Edison, Inc. (ED)

Con Edison is a company that provides energy to people. They recently shared their financial results for the end of 2022. The results showed that Con Edison made a little bit less money than they did in the same time period last year. This was because they sold less energy and had more expenses. For the whole year of 2022, they made a bit less money than they did in 2021, for the same reasons.

Even though they made a bit less money, Con Edison still met their goals for the year and did good things for the environment. They made more renewable energy projects and worked to make less pollution. The CEO of Con Edison said that even though there were some hard things that happened in 2022, like bad weather and the pandemic, he was proud of the workers who kept everything running safely and reliably.

ESG Credential of Consolidated Edison, Inc. (ED)

Consolidated Edison, Inc. (ED) is a company that cares about doing good things for the environment, people, and how it runs its business. They are trying to do their part to help the planet by making less pollution. They have set goals to make a lot less pollution by 2030 and 2040. They are also working on ways to make more energy from the sun, wind, and store it in batteries.

ED also wants to be a better company by making things fairer and better for everyone. They are working on making sure that everyone is treated equally and fairly. They are also making sure that their computer systems are safe from bad people. They want to make sure that their customers are happy and have good service.

Is Consolidated Edison (ED) a Good Stock for Investment?

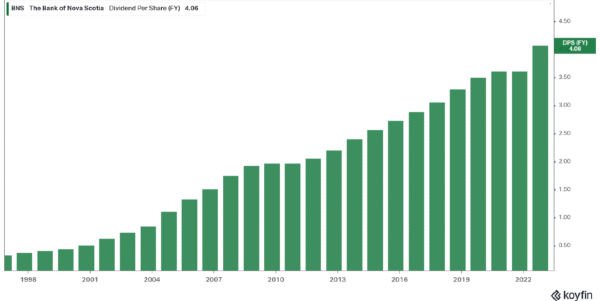

Consolidated Edison (NYSE:ED) is a company that has been helping people in the New York area with energy for a very long time. They have a good history of giving money back to their investors every year. They have been doing this for 50 years in a row! In this article, we will look at whether investing in Consolidated Edison is a good idea by looking at how much money they give back, what experts say, and how well they have done recently.

Consolidated Edison's Dividend Payments

Consolidated Edison's commitment to maintaining and growing its dividend makes it an attractive investment opportunity for income investors. Currently, the company pays an annual dividend of $3.24 per share, which results in a dividend yield of 3.53%. With a dividend payout ratio of 69.38%, the company's dividend payments are at a healthy and sustainable level, well below the 75% threshold.

Moreover, based on earnings estimates, the company is expected to have a dividend payout ratio of 64.93% next year. This indicates that the company will continue to be able to sustain or even increase its dividend payouts going forward.

Analyst Recommendations

Some smart people on Wall Street looked at Consolidated Edison (ED) and told other people who might want to buy it what they think. They gave different opinions like "buy," "hold," or "sell." But when they all talked together, they mostly agreed that it's better to "hold" ED shares for now. It's important to remember that these smart people don't always know for sure what will happen with the stock. People who want to buy, sell or keep the stock should think carefully about what they want and how much risk they're willing to take before they make any decisions.

SRE Latest Earnings

Sempra (NYSE:SRE) has reported an annual revenue of $14.83 billion, indicating that the company is generating significant income from its operations. Sempra has announced that it will release its next quarterly earnings report on Tuesday, February 28th, 2023. This report will provide a more detailed and up-to-date picture of the company's financial performance, including its revenue, net income, and other key financial metrics for the most recent quarter. It will also include important updates on the company's business operations and strategies for the future.

Investors and analysts will be keenly watching this earnings report to assess the company's financial health and make informed investment decisions. The earnings report will also give a sense of the company's performance relative to market expectations and may impact the stock's price in the short-term.

Conclusion

In conclusion, Consolidated Edison, Inc. (ED) is a company that makes energy and is very well known. People trust them because they are reliable and have different types of energy. But there are some things that can make it hard for them, like rules they have to follow, using things that can hurt the environment, and things that cost a lot of money. However, there are also good things they can do, like making energy from things that are good for the environment, using less energy, and working with other companies. The company is also trying to do good things, like making less pollution, treating everyone fairly, and using things that are good for the environment. Even though there are some challenges and risks, Consolidated Edison, Inc. should be able to do well in the future.

Read more: Vanguard utility index and clean energy fund

Consolidated Edison, Inc. (ED) is a company that helps people get electricity and natural gas in the New York City area. They have different things that they do to provide these services. This article talks about how the company works, what it is good at, and how it does with the money. And how it takes care of the environment and the people who live in the area.

Business Model of Consolidated Edison, Inc. (ED)

ED is a company that provides energy-related things to people in New York City. It has some smaller companies that help it do this. The government tells ED how much money it can charge people for its services. This helps the company make enough money to keep doing its job well and make sure people get what they need.

ED gets money by selling electricity and natural gas to different kinds of customers like homes, stores, and factories. They also have a smaller company called Con Edison Solutions that helps people with energy things in other parts of the country. The company also tries to help the environment by investing in things like renewable energy and ways to use less energy.

SWOT Analysis of Consolidated Edison, Inc. (ED)

SWOT analysis is a strategic planning tool that evaluates the Strengths, Weaknesses, Opportunities, and Threats of an organization. Here is a SWOT analysis for Consolidated Edison, Inc. (ED):

Strengths:

Strong brand reputation

Strong financial performance

Diverse energy portfolio

Reliable energy delivery

Weaknesses:

Regulation-dependent

Dependence on fossil fuels

High operational costs

Opportunities:

Threats:

Earning Report of Consolidated Edison, Inc. (ED)

Con Edison is a company that provides energy to people. They recently shared their financial results for the end of 2022. The results showed that Con Edison made a little bit less money than they did in the same time period last year. This was because they sold less energy and had more expenses. For the whole year of 2022, they made a bit less money than they did in 2021, for the same reasons.

Even though they made a bit less money, Con Edison still met their goals for the year and did good things for the environment. They made more renewable energy projects and worked to make less pollution. The CEO of Con Edison said that even though there were some hard things that happened in 2022, like bad weather and the pandemic, he was proud of the workers who kept everything running safely and reliably.

ESG Credential of Consolidated Edison, Inc. (ED)

Consolidated Edison, Inc. (ED) is a company that cares about doing good things for the environment, people, and how it runs its business. They are trying to do their part to help the planet by making less pollution. They have set goals to make a lot less pollution by 2030 and 2040. They are also working on ways to make more energy from the sun, wind, and store it in batteries.

ED also wants to be a better company by making things fairer and better for everyone. They are working on making sure that everyone is treated equally and fairly. They are also making sure that their computer systems are safe from bad people. They want to make sure that their customers are happy and have good service.

Is Consolidated Edison (ED) a Good Stock for Investment?

Consolidated Edison (NYSE:ED) is a company that has been helping people in the New York area with energy for a very long time. They have a good history of giving money back to their investors every year. They have been doing this for 50 years in a row! In this article, we will look at whether investing in Consolidated Edison is a good idea by looking at how much money they give back, what experts say, and how well they have done recently.

Consolidated Edison's Dividend Payments

Consolidated Edison's commitment to maintaining and growing its dividend makes it an attractive investment opportunity for income investors. Currently, the company pays an annual dividend of $3.24 per share, which results in a dividend yield of 3.53%. With a dividend payout ratio of 69.38%, the company's dividend payments are at a healthy and sustainable level, well below the 75% threshold.

Moreover, based on earnings estimates, the company is expected to have a dividend payout ratio of 64.93% next year. This indicates that the company will continue to be able to sustain or even increase its dividend payouts going forward.

Analyst Recommendations

Some smart people on Wall Street looked at Consolidated Edison (ED) and told other people who might want to buy it what they think. They gave different opinions like "buy," "hold," or "sell." But when they all talked together, they mostly agreed that it's better to "hold" ED shares for now. It's important to remember that these smart people don't always know for sure what will happen with the stock. People who want to buy, sell or keep the stock should think carefully about what they want and how much risk they're willing to take before they make any decisions.

SRE Latest Earnings

Sempra (NYSE:SRE) has reported an annual revenue of $14.83 billion, indicating that the company is generating significant income from its operations. Sempra has announced that it will release its next quarterly earnings report on Tuesday, February 28th, 2023. This report will provide a more detailed and up-to-date picture of the company's financial performance, including its revenue, net income, and other key financial metrics for the most recent quarter. It will also include important updates on the company's business operations and strategies for the future.

Investors and analysts will be keenly watching this earnings report to assess the company's financial health and make informed investment decisions. The earnings report will also give a sense of the company's performance relative to market expectations and may impact the stock's price in the short-term.

Conclusion

In conclusion, Consolidated Edison, Inc. (ED) is a company that makes energy and is very well known. People trust them because they are reliable and have different types of energy. But there are some things that can make it hard for them, like rules they have to follow, using things that can hurt the environment, and things that cost a lot of money. However, there are also good things they can do, like making energy from things that are good for the environment, using less energy, and working with other companies. The company is also trying to do good things, like making less pollution, treating everyone fairly, and using things that are good for the environment. Even though there are some challenges and risks, Consolidated Edison, Inc. should be able to do well in the future.

Read more: Vanguard utility index and clean energy fund