The last time The Bank of Nova Scotia (BNS) cut its dividend was back in 1942, in the midst of World War 2. Since then, no cuts have occurred despite the bank operating through multiple recessions and unfavorable trading environments.

Accoridngly, the Bank of Nova Scotia has earned a strong reputation amongst income-oriented investors.

As payouts have continued to grow during the current highly uncertain landscape against a declining share price, the stock now yields a hefty 6.2%.

With the stock’s yield significantly higher than its historical average and its valuation implying a notable discount, it may be an ideal time for income-oriented to consider the Bank of Nova Scotia for their portfolios.

The Bank of Nova Scotia is one of the high-yield stocks in our database.

You can download your free full list of all securities with 5%+ yields (along with important financial metrics such as dividend yield and payout ratio) by clicking on the link below:

Click here to instantly download your free high dividend stocks spreadsheet now, along with important investing metrics.

This article will analyze the Bank of Nova Scotia (BNS).

Business Overview

The Bank of Nova Scotia (also known as Scotiabank) is the fourth-largest financial institution in Canada, behind the Royal Bank of Canada (RY), the Toronto-Dominion Bank (TD), and the Bank of Montreal (BMO).

Scotiabank operates through its four core business segments – Canadian Banking, International Banking, Global Wealth Management, and Global Banking & Markets.

Employing 90,000 people and managing assets of over $1.3 trillion, Scotiabank is cross-listed on the Toronto Stock Exchange (TSX: BNS) and the New York Stock Exchange (NYSE: BNS).

The company is now facing headwinds, mainly in its Canadian Banking and Wealth Management segments, as a result of a tough macroeconomic landscape.

Specifically, in its most recent Q4 results, The Canadian Banking business saw adjusted net income decline by 5% to C$1.2 billion due to higher provisions for credit losses. Further, the Global Wealth Management segment reported a 4% decline in revenues due to lower mutual fund fees as a result of market volatility and lower asset values.

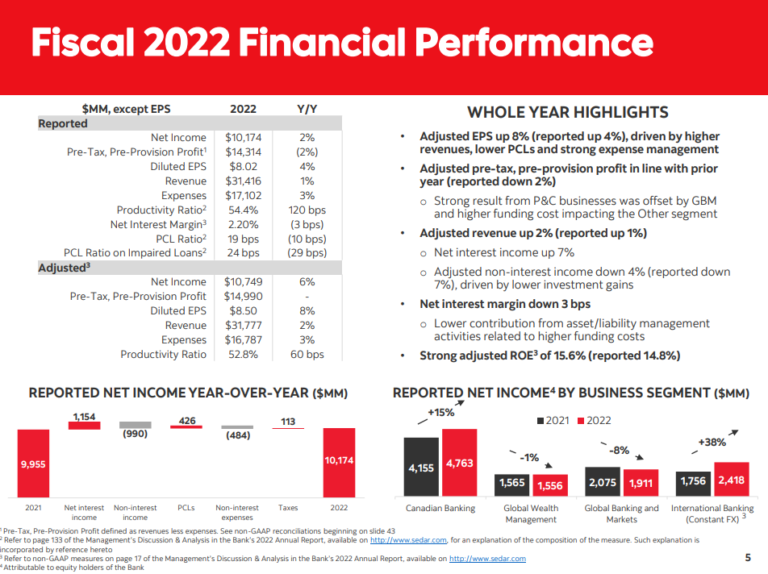

Nevertheless, the bank’s overall performance for the year remained rather robust, with FY2022 revenues rising by 2% to C$31.8 billion and earnings-per-share climbing 8% to C$8.50 (US$6.26).

Growth Prospects

Scotiabank has gradually grown its revenues and earnings-per-share over the years as it expands its domestic and international lending operations, as well as its total assets under management.

The ongoing macroeconomic environment is presently negatively impacting some of the company’s segments but benefits others. For instance, with rising interest rates compressing the valuation of its assets under management and reducing inflows, non-interest income declined by around 7% to C$13.3 billion in FY2022. That said, the company has been able to achieve higher lending spreads in the meantime, with net interest income rising 7% during the year.

We believe that Scotiabank is going to traverse the current environment resiliently and come out the other side stronger due to its robust asset base and prudent risk management, as it has done multiple times in the past.

We expect both its earnings-per-share and dividend to grow in the mid-single digits moving forward, excluding any surprising currency tailwinds/headwinds in the CAD/USD exchange rate.

Competitive Advantages & Recession Resiliency

Scotiabank has a competitive edge due to its pursuit of growth opportunities beyond its main markets. This international expansion, particularly in Latin American countries such as Mexico, Peru, and Chile, should be a driver of growth in the future once global economic conditions improve.

Scotiabank’s focus on international expansion is taking a small toll on the bank’s performance, but its dividends remain well-covered based on its underlying earnings.

We also believe Scotiabank’s performance during a recession is going to be much less harsh than its industry peers due to its prudent management and capital allocation strategy.

Even during the Great Financial Crisis, which was one of the harshest environments for banks ever, Scotiabank performed well. Its earnings-per-share declined by “only” 25% in 2008 and, by 2010, had already rebounded to 2007 levels.

The bank’s capital position remains solid as well, with its Common Equity Tier 1 ratio at 11.5%.

Dividend Analysis

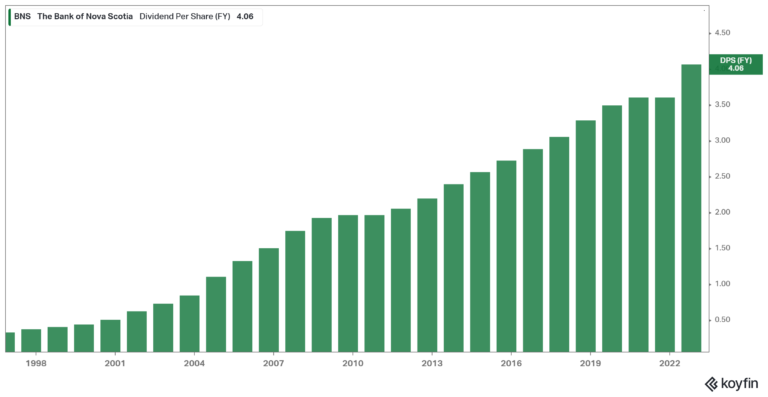

Scotiabank features one of the most impressive dividend track records globally, let alone amongst its industry peers. As mentioned, the last time the company was forced to cut its dividend was during World War 2. Since then, dividends have only grown or remained stable during very harsh market environments.

During the Great Recession, for instance, Scotiabank continued to grow its dividend and only skipped an increase in 2010 before resuming dividend growth afterward.

Similarly, the OSFI regulatory restriction led to a dividend freeze for nine quarters during the pandemic. The bank came out with a dividend increase as soon as the ban was lifted.

Scotiabank’s dividend has grown at a 20-year CAGR of 9% despite such pauses, and we expect dividend increases to continue surfacing in the mid-single-digits over the medium term.

The payout ratio remains at rather comfortable levels, currently at 48% based on our expected earnings-per-share for FY2023.

Final Thoughts

Scotiabank has exhibited an incredible track record of growing dividends and shareholders’ wealth that spans several decades.

The ongoing market environment is negatively impacting some of its segments, but through prudent capital management and favorable lending results, the bank once again grew its earnings-per-share in FY2022 and is expected to do so again in FY2023.

Scotiabank’s shares are currently trading with a multi-year-high yield of 6.2% attached. The stock’s P/E also stands at an attractive at ~8 times our earnings expectations for the year.

Thus, Scotiabank could be an attractive, quality pick for income-oriented investors looking for a hefty yield along with a wide margin of safety.

Image Source: Koyfin.com

The last time The Bank of Nova Scotia (BNS) cut its dividend was back in 1942, in the midst of World War 2. Since then, no cuts have occurred despite the bank operating through multiple recessions and unfavorable trading environments.

Accoridngly, the Bank of Nova Scotia has earned a strong reputation amongst income-oriented investors.

As payouts have continued to grow during the current highly uncertain landscape against a declining share price, the stock now yields a hefty 6.2%.

With the stock’s yield significantly higher than its historical average and its valuation implying a notable discount, it may be an ideal time for income-oriented to consider the Bank of Nova Scotia for their portfolios.

The Bank of Nova Scotia is one of the high-yield stocks in our database.

You can download your free full list of all securities with 5%+ yields (along with important financial metrics such as dividend yield and payout ratio) by clicking on the link below:

Click here to instantly download your free high dividend stocks spreadsheet now, along with important investing metrics.

This article will analyze the Bank of Nova Scotia (BNS).

Business Overview

The Bank of Nova Scotia (also known as Scotiabank) is the fourth-largest financial institution in Canada, behind the Royal Bank of Canada (RY), the Toronto-Dominion Bank (TD), and the Bank of Montreal (BMO).

Scotiabank operates through its four core business segments – Canadian Banking, International Banking, Global Wealth Management, and Global Banking & Markets.

Employing 90,000 people and managing assets of over $1.3 trillion, Scotiabank is cross-listed on the Toronto Stock Exchange (TSX: BNS) and the New York Stock Exchange (NYSE: BNS).

The company is now facing headwinds, mainly in its Canadian Banking and Wealth Management segments, as a result of a tough macroeconomic landscape.

Specifically, in its most recent Q4 results, The Canadian Banking business saw adjusted net income decline by 5% to C$1.2 billion due to higher provisions for credit losses. Further, the Global Wealth Management segment reported a 4% decline in revenues due to lower mutual fund fees as a result of market volatility and lower asset values.

Source: Investor Presentation

Nevertheless, the bank’s overall performance for the year remained rather robust, with FY2022 revenues rising by 2% to C$31.8 billion and earnings-per-share climbing 8% to C$8.50 (US$6.26).

Growth Prospects

Scotiabank has gradually grown its revenues and earnings-per-share over the years as it expands its domestic and international lending operations, as well as its total assets under management.

The ongoing macroeconomic environment is presently negatively impacting some of the company’s segments but benefits others. For instance, with rising interest rates compressing the valuation of its assets under management and reducing inflows, non-interest income declined by around 7% to C$13.3 billion in FY2022. That said, the company has been able to achieve higher lending spreads in the meantime, with net interest income rising 7% during the year.

We believe that Scotiabank is going to traverse the current environment resiliently and come out the other side stronger due to its robust asset base and prudent risk management, as it has done multiple times in the past.

We expect both its earnings-per-share and dividend to grow in the mid-single digits moving forward, excluding any surprising currency tailwinds/headwinds in the CAD/USD exchange rate.

Competitive Advantages & Recession Resiliency

Scotiabank has a competitive edge due to its pursuit of growth opportunities beyond its main markets. This international expansion, particularly in Latin American countries such as Mexico, Peru, and Chile, should be a driver of growth in the future once global economic conditions improve.

Scotiabank’s focus on international expansion is taking a small toll on the bank’s performance, but its dividends remain well-covered based on its underlying earnings.

We also believe Scotiabank’s performance during a recession is going to be much less harsh than its industry peers due to its prudent management and capital allocation strategy.

Even during the Great Financial Crisis, which was one of the harshest environments for banks ever, Scotiabank performed well. Its earnings-per-share declined by “only” 25% in 2008 and, by 2010, had already rebounded to 2007 levels.

The bank’s capital position remains solid as well, with its Common Equity Tier 1 ratio at 11.5%.

Dividend Analysis

Scotiabank features one of the most impressive dividend track records globally, let alone amongst its industry peers. As mentioned, the last time the company was forced to cut its dividend was during World War 2. Since then, dividends have only grown or remained stable during very harsh market environments.

During the Great Recession, for instance, Scotiabank continued to grow its dividend and only skipped an increase in 2010 before resuming dividend growth afterward.

Similarly, the OSFI regulatory restriction led to a dividend freeze for nine quarters during the pandemic. The bank came out with a dividend increase as soon as the ban was lifted.

Image Source: Koyfin.com

Scotiabank’s dividend has grown at a 20-year CAGR of 9% despite such pauses, and we expect dividend increases to continue surfacing in the mid-single-digits over the medium term.

The payout ratio remains at rather comfortable levels, currently at 48% based on our expected earnings-per-share for FY2023.

Final Thoughts

Scotiabank has exhibited an incredible track record of growing dividends and shareholders’ wealth that spans several decades.

The ongoing market environment is negatively impacting some of its segments, but through prudent capital management and favorable lending results, the bank once again grew its earnings-per-share in FY2022 and is expected to do so again in FY2023.

Scotiabank’s shares are currently trading with a multi-year-high yield of 6.2% attached. The stock’s P/E also stands at an attractive at ~8 times our earnings expectations for the year.

Thus, Scotiabank could be an attractive, quality pick for income-oriented investors looking for a hefty yield along with a wide margin of safety.

Originally Posted on suredividend.com