By the time of this article release, I have now had a daily investment into Vanguard’s Dividend Appreciation ETF (VIG), another wonderful Vanguard ETF.

The community knows I buy Vanguard’s S&P 500 (VOO) daily and Vanguard’s High Dividend Yield (VYM) weekly, so what gives?

Therefore, it’s time to break down why I’m investing into VIG daily!

Vanguard Dividend Appreciation ETF (VIG)

As you saw in my previous article, where I broke down the Vanguard ETF trifecta, VIG was on the list.

VIG is another low cost exchange traded fund (ETF), with a 0.06% expense ratio. That means $0.60 per $1,000 that is invested.

The ETF is composed of 289 different dividend growth stocks, and here are the top 10 stocks that VIG is composed of:

If you look at this list, we are talking HIGH dividend growth for many above. UNH raised it 14%, Microsoft stood strong at 9.7%, JPMorgan raised it 11% last time and Visa even came in rocking with a 20% dividend growth rate. Therefore, dividend growth is high for this ETF.

The difference with VYM is just that, growth. You will not have the highest dividend yielding stocks in this ETF. VYM is about an even balance of yield plus growth, such as a 2.5%-3.5% dividend yield with a 6.5%-7.5% dividend growth rate, which is solid.

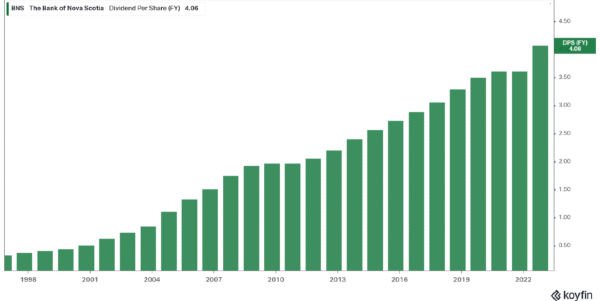

VIG, however, is about the later, the dividend growth. The yield is better than the S&P 500 ETF by ~30 basis points or 0.30%. However, as notated in the last article, the dividend growth rate is ~9%. Therefore, in time, the yield on cost will overcome Vanguard High Dividend Yield ETF. In addition, the growth rate over the last 5 years was also higher than the S&P 500 ETF of VOO.

I want to retire early, though. The question may be, “how does VIG get me there?”. It does, but it also is coming from additional savings I have that wasn’t being used.

One could argue that I am sacrificing current yield for future growth, this is true. That I cannot deny. However, when I am in my 50’s, yes, 50’s, the yield on cost will be higher than my yield on cost on other investments, more than likely. Given I may not be investing that much later on, it will be critical in retirement to make sure my income is growing at a strong pace, at least out pacing any unusual rate of high or super inflation.

Here is my borrowed image from my previous article:

My daily VIG Investing Plan

Time to add to my investing strategy. Therefore, I am investing $30 per day into VIG. That is $150 per week, no matter what. That does not seem like a lot BUT that is $7,800 going into an ETF that should continue to have strong growth AND passive income growth!

Therefore, when you break down my ETFs, I am doing:

- $60/per day into Vanguard S&P 500 ETF (VOO) = $300/week or $15,600/year

- $200/per week into Vanguard High Dividend Yield ETF (VYM) = $200/week or $10,400/year

- $30/per day into Vanguard Dividend Appreciation ETF (VIG) = $150/week or $7,800/year

- In total, I am investing $33,800 into Vanguard ETFs as my goal for 2023, at least trying to!

What VIG will be bringing to the table is higher dividend growth and total return, vs. VYM. Then, when I am really (and hopefully) hitting the stride in retirement, the VIG should take off and really grow our dividend income stream in retirement.

Buying VIG daily will add a nice punch to my overall dividend stock portfolio Even though you could be earning a LOT on your idle cash right now, I am still, and always, looking forward to put my money to work.

What are your thoughts on the Vanguard ETF investing strategy? What is your favorite Vanguard ETF and are you pursuing a similar investing strategy? What do you have set up to automatically buy, no matter what the stock market is doing? Please share below in the comment section!

As always, thank you for stopping by, good luck and happy investing!

-Lanny

By the time of this article release, I have now had a daily investment into Vanguard’s Dividend Appreciation ETF (VIG), another wonderful Vanguard ETF.

The community knows I buy Vanguard’s S&P 500 (VOO) daily and Vanguard’s High Dividend Yield (VYM) weekly, so what gives?

Therefore, it’s time to break down why I’m investing into VIG daily!

Vanguard Dividend Appreciation ETF (VIG)

As you saw in my previous article, where I broke down the Vanguard ETF trifecta, VIG was on the list.

VIG is another low cost exchange traded fund (ETF), with a 0.06% expense ratio. That means $0.60 per $1,000 that is invested.

The ETF is composed of 289 different dividend growth stocks, and here are the top 10 stocks that VIG is composed of:

If you look at this list, we are talking HIGH dividend growth for many above. UNH raised it 14%, Microsoft stood strong at 9.7%, JPMorgan raised it 11% last time and Visa even came in rocking with a 20% dividend growth rate. Therefore, dividend growth is high for this ETF.

The difference with VYM is just that, growth. You will not have the highest dividend yielding stocks in this ETF. VYM is about an even balance of yield plus growth, such as a 2.5%-3.5% dividend yield with a 6.5%-7.5% dividend growth rate, which is solid.

VIG, however, is about the later, the dividend growth. The yield is better than the S&P 500 ETF by ~30 basis points or 0.30%. However, as notated in the last article, the dividend growth rate is ~9%. Therefore, in time, the yield on cost will overcome Vanguard High Dividend Yield ETF. In addition, the growth rate over the last 5 years was also higher than the S&P 500 ETF of VOO.

I want to retire early, though. The question may be, “how does VIG get me there?”. It does, but it also is coming from additional savings I have that wasn’t being used.

One could argue that I am sacrificing current yield for future growth, this is true. That I cannot deny. However, when I am in my 50’s, yes, 50’s, the yield on cost will be higher than my yield on cost on other investments, more than likely. Given I may not be investing that much later on, it will be critical in retirement to make sure my income is growing at a strong pace, at least out pacing any unusual rate of high or super inflation.

Here is my borrowed image from my previous article:

My daily VIG Investing Plan

Time to add to my investing strategy. Therefore, I am investing $30 per day into VIG. That is $150 per week, no matter what. That does not seem like a lot BUT that is $7,800 going into an ETF that should continue to have strong growth AND passive income growth!

Therefore, when you break down my ETFs, I am doing:

What VIG will be bringing to the table is higher dividend growth and total return, vs. VYM. Then, when I am really (and hopefully) hitting the stride in retirement, the VIG should take off and really grow our dividend income stream in retirement.

Buying VIG daily will add a nice punch to my overall dividend stock portfolio Even though you could be earning a LOT on your idle cash right now, I am still, and always, looking forward to put my money to work.

What are your thoughts on the Vanguard ETF investing strategy? What is your favorite Vanguard ETF and are you pursuing a similar investing strategy? What do you have set up to automatically buy, no matter what the stock market is doing? Please share below in the comment section!

As always, thank you for stopping by, good luck and happy investing!

-Lanny

Originally Posted in Dividend Diplomats