Sound investments

don't happen alone

Find your crew, build teams, compete in VS MODE, and identify investment trends in our evergrowing investment ecosystem. You aren't on an island anymore, and our community is here to help you make informed decisions in a complex world.

February 17, 2023 – I’m away from my home office, so this will be short and sweet.

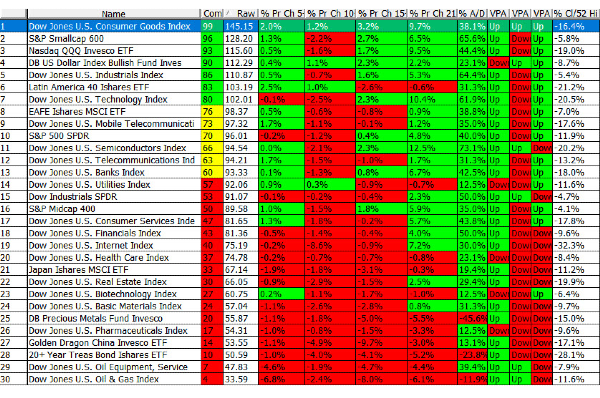

If you look at the price chart of just about any index, not much happened last week except volatility. The big concern (along with interest rates and inflation) is 0DTE (zero days until expiration) options. These are one day to same days options that expire. You can call them “Day Trades” or gambling, but in any case there volume is growing and significant. The Wall Street dealers and market makers are getting concerned that the “tail is wagging the dog”. The reason is when an option order is placed, the option writer takes out a position to maintain “Delta Neutral”. Think of it as a method of minimizing risk of the option being exercised / profitable. Thus we have short term gyrations in prices. The concern is a major swing because “buying begets buying and selling begets selling”. i.e. The option dealers would be forced to sell to maintain Delta Neutral in a falling market which leads to more selling.

Obviously is is not investing, and could hurt the markets. What to do? Actually not much until some type of trend is established to make such activities less profitable. Have a good week. ……….. Tom ……………