Introduction

In early 2021 the stock market experienced an extraordinary event that has never been seen before in the market with this magnitude. Ultimately catching the attention of retail and institutional investors worldwide. I am talking about the GameStop (GME) short squeeze. The hype all started in 2020 thanks to one person known on reddit.com/r/wallstreetbets/ as “Deepfuckingvalue” or “Roaring Kitty” where he expresses his fundamental idea behind the short squeeze of GME (GameStop).

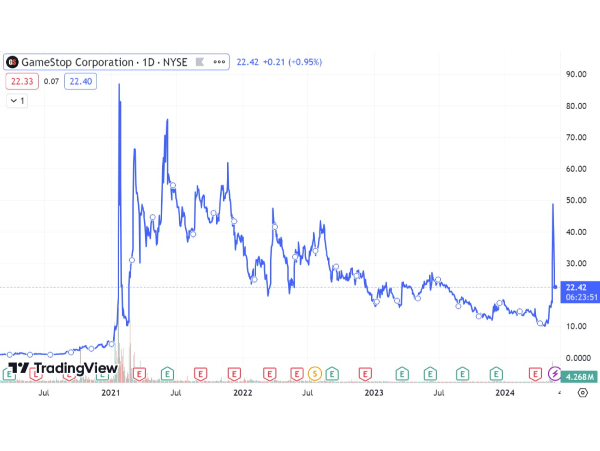

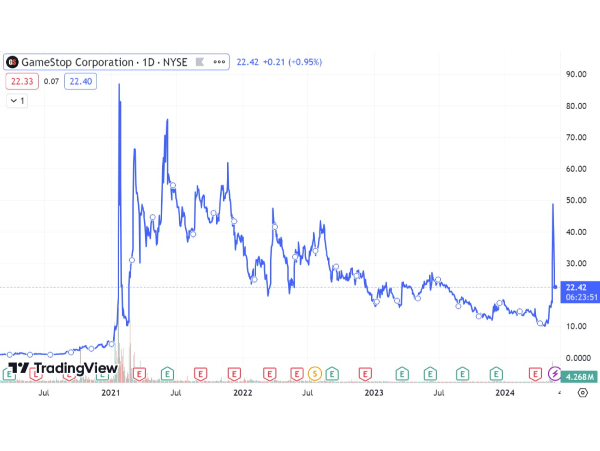

During the year, his idea gained massive traction on social media platforms and many retail investors followed his proposition. In the start of 2021 (January 4th) the stock price skyrocketed from $4.87 to a peak of $86.88 on the 27th of January. A total return of over 1600% in a time span of only one month. Volatility remained incredibly high over the following months with significant price swings occurring daily. However, after the hype started to fade, the share price decreased significantly back to its real fundamental values. Now in May 2024, Roaring Kitty reappeared on the internet after not posting for over 3 years. His tweet got global media attention and caused the GME to skyrocket again as we can see at the end of the graph. This article delves in to the GME shorts squeeze, the role of Robinhood during the short squeeze of 2021, other stocks that followed a similar trend during this time and finally the impact of this phenomenon on the stock market and its investors.

Figure 1: GameStop stock price

What is a short squeeze?

A short squeeze occurs when a stock that is heavily shorted by investors, suddenly increases sharply in price. More specifically, many investors have a short position in the stock thinking that the share price would decrease over time. However, due to certain market events or news related to the company, the share price rises and short sellers are forced to buy back shares in order to cover their positions. Ultimately, driving up the price even more. Noteworthy, is that short sellers borrow shares to sell them at the current price, hoping to buy back the shares at a lower price in the future. However, the opposite happens during a short squeeze and the investors are forced to close their short positions to prevent even bigger losses.

The GameStop saga

GameStop is an American retailer of videogames and their business model relied on reselling physical copies of videogames. Many large institutions took short positions in this company before 2021 due to an outdated business model that had to compete with innovative digital distribution services, declining sales as well as the covid pandemic causing many GameStop stores to close down. The company was set up to go bankrupt. However, members of the subreddit r/WallStreetBets saw an opportunity to challenge these institutional short sellers.

The WallstreetBets community and other retail investors worldwide teamed up and massively decided to start buying GameStop shares and options. Ultimately gaining global market attention which caused a buying frenzy that sent the stock price into the stratosphere from around $4 in early January 2021 to a peak of $86.88 on the 27th of January 2021. An astonishing return of more than 2000% in one month! It is possible to say that the increase in share price was fueled by financial motives, retail investors wanting to punish the large institutions and social media hype.

The role of Robinhood

Unfortunately, the short squeeze was too good to be true and the stock price crashed a few days later as we can see in figure 1 above. So what was the catalyst for the crash? The majority of the retail investors were trading GameStop shares on Robinhood, an electronic trading platform which was very easy to use and had very low transaction fees. The problem however, during the trading period around the peak of GameStop, the trading volume and volatility of GME shares was too big for Robinhood. At this moment in time, they were not able to clear sales due to a lack of collateral (a deficit of $3 billion) to meet the clearing fund requirements. As a result, Robinhood was forced to suspend trading on GameStop and other stocks like AMC that were experiencing a short squeeze as well.

When the trading (buying) of GameStop shares got halted by Robinhood, this caused massive panic for retail investors as they were not able to continue the short squeeze anymore. Ultimately, affecting market sentiment as retail investors saw this move as a protectionist measure for institutional investors who had short positions in GameStop. Market sentiment quickly changed since retail investors were not able to buy but only sell GameStop shares and as a result the stock price plummeted. This policy prevented large hedge funds and other institutions from incurring any further losses while retail investors were capped at any further gains due to the inability to buy long positions in GameStop.

After the GameStop saga and the suspension of trading, Robinhood received a lot of backlash due to the fact that many retail investors viewed their decision as unethical, amateuristic and in favor of institutional investors. Hence, the retail investors were harmed by the inefficiency of Robinhood. In 2021, some investors started a lawsuit against Robinhood since they considered their actions to be an act of market manipulation. However, the lawsuit did get rejected as Robinhood justified that their actions were solely to meet liquidity requirements.

Other stocks that experienced a similar pattern

During the short squeeze hype of GameStop, a few other stocks followed a similar pattern. Especially the stocks that were heavily shorted by institutions as well. Retail investors were all gathering together in order to find stocks with a high short interest, meaning that many investors betted that the share price will go down in the near future. Ultimately buying up all these shares in order to try and create another short squeeze. Below are a few other stocks mentioned that experienced a short squeeze:

The short squeeze and the long term effects on the stock market

It comes as no surprise that the GameStop saga had an immediate and long term impact on the stock market as both retail investors, brokers and institutional investors have never experienced volatility like this before. The GameStop short squeeze was the first time retail investors combined forces in order to fight the big boys at Wall Street. The large price movements led to increased volatility in the stock. Ultimately causing huge swings in stock prices and liquidity issues for brokers like Robinhood. Furthermore, the freeze on trading GameStop shares on Robinhood also put more pressure on future regulations with respect to trading platforms and their transparency. The SEC (US Securities and Exchange Commission) stated that they will closely monitor the actions taken by regulated entities that may disadvantage investors or prevent investors from trading certain securities. Furthermore, the SEC started to consider new regulations that will prevent similar problems from occurring in the future.

The GameStop phenomenon did show the power of retail investors and their impact on the stock market. All retail investors combined were able to short squeeze some of the biggest hedge funds in America. This demonstrates the growing influence of retail investors in the stock market. Furthermore, with the help of social media attention and online communities like Wallstreetbets, small investors are able to team up and make coordinated investment strategies in order to impact the stock market significantly.

The short squeeze of GME in 2024

Now in 2024, Roaring kitty resurfaced on the internet (Twitter) after not posting for over 3 years since the GameStop short squeeze in 2021. On the 12th of May 2024 he posted a meme which immediately got global social media attention from retail investors from all over the world. Many investors were incentivized this could be the second short squeeze of GameStop and immediately starting buying the stock, causing GME to skyrocket almost 100% on Monday the 13th 2024. On Tuesday the 14th, the stock continued to rapidly rise in price, forcing the stock to be halted several times during the day. However, the stock continued to increase from around $30 to a closing price of $48.75 at the end of the day. Unfortunately, the hype and volatility was only for short term. After the two volatile trading days, the hype and short squeeze intentions faded and GameStop shares plummeted again. At the end of the week, on Friday the 17th, the stock closed at a price of $22.21. Hence, the hype behind the second short squeeze was exaggerated and quickly faded.

Figure 2: Tweet from Roaring Kitty on May 12th 2024

Conclusion

The GameStop saga has been a historical event in 2021, showcasing the true power of retail investors when they work together towards a common goal. Social media and other online platforms like reddit further played a major role in gathering individual investors together. With investing becoming more mainstream for individual investors, their influence on the stock market will only get bigger in the future.

However, it is important to note that a short squeeze is definitely not a get quick rich scheme. It is a very complex economic phenomenon. While there are some individuals that made huge profits during the short squeeze, many investors lost a lot of money by entering the market too late or even got boycotted with the trading halt by Robinhood, forcing investors to sell at a loss. To conclude, investors must stay up to date about the risks and opportunities presented by such events. Understanding the economic rational behind a short squeeze and the factors driving market hype can help investors navigate through such market environments and as a result, make better investment decisions.

Introduction

In early 2021 the stock market experienced an extraordinary event that has never been seen before in the market with this magnitude. Ultimately catching the attention of retail and institutional investors worldwide. I am talking about the GameStop (GME) short squeeze. The hype all started in 2020 thanks to one person known on reddit.com/r/wallstreetbets/ as “Deepfuckingvalue” or “Roaring Kitty” where he expresses his fundamental idea behind the short squeeze of GME (GameStop).

During the year, his idea gained massive traction on social media platforms and many retail investors followed his proposition. In the start of 2021 (January 4th) the stock price skyrocketed from $4.87 to a peak of $86.88 on the 27th of January. A total return of over 1600% in a time span of only one month. Volatility remained incredibly high over the following months with significant price swings occurring daily. However, after the hype started to fade, the share price decreased significantly back to its real fundamental values. Now in May 2024, Roaring Kitty reappeared on the internet after not posting for over 3 years. His tweet got global media attention and caused the GME to skyrocket again as we can see at the end of the graph. This article delves in to the GME shorts squeeze, the role of Robinhood during the short squeeze of 2021, other stocks that followed a similar trend during this time and finally the impact of this phenomenon on the stock market and its investors.

Figure 1: GameStop stock price

What is a short squeeze?

A short squeeze occurs when a stock that is heavily shorted by investors, suddenly increases sharply in price. More specifically, many investors have a short position in the stock thinking that the share price would decrease over time. However, due to certain market events or news related to the company, the share price rises and short sellers are forced to buy back shares in order to cover their positions. Ultimately, driving up the price even more. Noteworthy, is that short sellers borrow shares to sell them at the current price, hoping to buy back the shares at a lower price in the future. However, the opposite happens during a short squeeze and the investors are forced to close their short positions to prevent even bigger losses.

The GameStop saga

GameStop is an American retailer of videogames and their business model relied on reselling physical copies of videogames. Many large institutions took short positions in this company before 2021 due to an outdated business model that had to compete with innovative digital distribution services, declining sales as well as the covid pandemic causing many GameStop stores to close down. The company was set up to go bankrupt. However, members of the subreddit r/WallStreetBets saw an opportunity to challenge these institutional short sellers.

The WallstreetBets community and other retail investors worldwide teamed up and massively decided to start buying GameStop shares and options. Ultimately gaining global market attention which caused a buying frenzy that sent the stock price into the stratosphere from around $4 in early January 2021 to a peak of $86.88 on the 27th of January 2021. An astonishing return of more than 2000% in one month! It is possible to say that the increase in share price was fueled by financial motives, retail investors wanting to punish the large institutions and social media hype.

The role of Robinhood

Unfortunately, the short squeeze was too good to be true and the stock price crashed a few days later as we can see in figure 1 above. So what was the catalyst for the crash? The majority of the retail investors were trading GameStop shares on Robinhood, an electronic trading platform which was very easy to use and had very low transaction fees. The problem however, during the trading period around the peak of GameStop, the trading volume and volatility of GME shares was too big for Robinhood. At this moment in time, they were not able to clear sales due to a lack of collateral (a deficit of $3 billion) to meet the clearing fund requirements. As a result, Robinhood was forced to suspend trading on GameStop and other stocks like AMC that were experiencing a short squeeze as well.

When the trading (buying) of GameStop shares got halted by Robinhood, this caused massive panic for retail investors as they were not able to continue the short squeeze anymore. Ultimately, affecting market sentiment as retail investors saw this move as a protectionist measure for institutional investors who had short positions in GameStop. Market sentiment quickly changed since retail investors were not able to buy but only sell GameStop shares and as a result the stock price plummeted. This policy prevented large hedge funds and other institutions from incurring any further losses while retail investors were capped at any further gains due to the inability to buy long positions in GameStop.

After the GameStop saga and the suspension of trading, Robinhood received a lot of backlash due to the fact that many retail investors viewed their decision as unethical, amateuristic and in favor of institutional investors. Hence, the retail investors were harmed by the inefficiency of Robinhood. In 2021, some investors started a lawsuit against Robinhood since they considered their actions to be an act of market manipulation. However, the lawsuit did get rejected as Robinhood justified that their actions were solely to meet liquidity requirements.

Other stocks that experienced a similar pattern

During the short squeeze hype of GameStop, a few other stocks followed a similar pattern. Especially the stocks that were heavily shorted by institutions as well. Retail investors were all gathering together in order to find stocks with a high short interest, meaning that many investors betted that the share price will go down in the near future. Ultimately buying up all these shares in order to try and create another short squeeze. Below are a few other stocks mentioned that experienced a short squeeze:

The short squeeze and the long term effects on the stock market

It comes as no surprise that the GameStop saga had an immediate and long term impact on the stock market as both retail investors, brokers and institutional investors have never experienced volatility like this before. The GameStop short squeeze was the first time retail investors combined forces in order to fight the big boys at Wall Street. The large price movements led to increased volatility in the stock. Ultimately causing huge swings in stock prices and liquidity issues for brokers like Robinhood. Furthermore, the freeze on trading GameStop shares on Robinhood also put more pressure on future regulations with respect to trading platforms and their transparency. The SEC (US Securities and Exchange Commission) stated that they will closely monitor the actions taken by regulated entities that may disadvantage investors or prevent investors from trading certain securities. Furthermore, the SEC started to consider new regulations that will prevent similar problems from occurring in the future.

The GameStop phenomenon did show the power of retail investors and their impact on the stock market. All retail investors combined were able to short squeeze some of the biggest hedge funds in America. This demonstrates the growing influence of retail investors in the stock market. Furthermore, with the help of social media attention and online communities like Wallstreetbets, small investors are able to team up and make coordinated investment strategies in order to impact the stock market significantly.

The short squeeze of GME in 2024

Now in 2024, Roaring kitty resurfaced on the internet (Twitter) after not posting for over 3 years since the GameStop short squeeze in 2021. On the 12th of May 2024 he posted a meme which immediately got global social media attention from retail investors from all over the world. Many investors were incentivized this could be the second short squeeze of GameStop and immediately starting buying the stock, causing GME to skyrocket almost 100% on Monday the 13th 2024. On Tuesday the 14th, the stock continued to rapidly rise in price, forcing the stock to be halted several times during the day. However, the stock continued to increase from around $30 to a closing price of $48.75 at the end of the day. Unfortunately, the hype and volatility was only for short term. After the two volatile trading days, the hype and short squeeze intentions faded and GameStop shares plummeted again. At the end of the week, on Friday the 17th, the stock closed at a price of $22.21. Hence, the hype behind the second short squeeze was exaggerated and quickly faded.

Figure 2: Tweet from Roaring Kitty on May 12th 2024

Conclusion

The GameStop saga has been a historical event in 2021, showcasing the true power of retail investors when they work together towards a common goal. Social media and other online platforms like reddit further played a major role in gathering individual investors together. With investing becoming more mainstream for individual investors, their influence on the stock market will only get bigger in the future.

However, it is important to note that a short squeeze is definitely not a get quick rich scheme. It is a very complex economic phenomenon. While there are some individuals that made huge profits during the short squeeze, many investors lost a lot of money by entering the market too late or even got boycotted with the trading halt by Robinhood, forcing investors to sell at a loss. To conclude, investors must stay up to date about the risks and opportunities presented by such events. Understanding the economic rational behind a short squeeze and the factors driving market hype can help investors navigate through such market environments and as a result, make better investment decisions.