Key Takeaways

- Matterport (MTTR) is the best investment opportunity from this list of metaverse stocks; however, it is being acquired in Q2 2024.

- Super League Gaming (SLGG) is the purest play as a metaverse investment in the list. Their fate will live or die with the metaverse.

- Meta Materials (MMAT) is the worst investment on the list and should barely be considered a metaverse play.

The Metaverse Penny Stock Landscape

In the metaverse penny stock universe, there are two broad categories. The first are ever-evolving media companies. These companies are conducting advertising in exciting new ways. Some are penetrating virtual 3-D advertising, while others are all-in on influencer marketing. These companies are advertising in ways that would be unrecognizable 10 years ago and are using the metaverse to showcase these ads.

The other side of the penny stock landscape are technology startups. There are companies trying to create new hardware or new technologies that support the metaverse. The most successful in this category is Matterport (MTTR) which is digitizing home properties for online tours. Unfortunately, Matterport will soon be bought out.

What is Meta Materials (MMAT)?

Meta Materials is a materials research company in which a portion of their products could penetrate certain metaverse hardware markets. From looking at a variety of meta materials products, the company has a very small footprint in metaverse related businesses.

The closest business is optical in the augmented reality sub-sector. Meta Material augmented reality products look to be in advanced stages of research, but possibly not in full scale production with an OEM (original equipment manufacturer). An OEM in this segment would be a company like Meta Platforms; however, being that their annual revenue is low (no more than $10 million), they probably do not yet have a major OEM contract for their augmented reality products like Holo Optix.

Example of meta material augmented reality products

So, they aren’t really a great stock to get into the metaverse. The company is into research and development of materials, and they aren’t really focused enough on metaverse optics to be a serious player in augmented reality, for now.

Looking at their product selections, they really seem to be too random with their product research. Besides the optical research, the company is researching a non-evasive glucose monitoring system. They are also involved in banknote security? That is a very far cry from the metaverse, augmented reality, and especially cryptocurrency.

The company’s revenue is just not existent. Right now in Q2 2024, they have a lot of opportunities but they are still looking for the right market for their products. Without any real financials, the company is not really a strong investment opportunity until they find that right market.

Gaming and Entertainment with Enthusiast Gaming (EGLXF)

Enthusiast Gaming is becoming a big player in a burgeoning new sub-sector. The company is focused on multiple channels that provide gaming entertainment. You can think of them as the ESPN of gaming, back when ESPN had just started to report on sports. The company has structured their offerings through different channels, with their first segment being YouTube and Twitch content. The next being competitive gaming teams and gaming events.

The company’s relevance in the metaverse is mixed. Again, they are the ESPN of e-sports. And they are creating content, communities around multiple games in different metaverses.

The company has metaverse related content through Twitch, YouTube, and websites that create content about multiple metaverses. While some content creators in Enthusiast Gaming focus on specific games, others will cover a wide spectrum of games. Metaverses like Roblox, Battle.net, League of Legends, and Minecraft all get covered by the communities developed by Enthusiast Gaming Holdings.

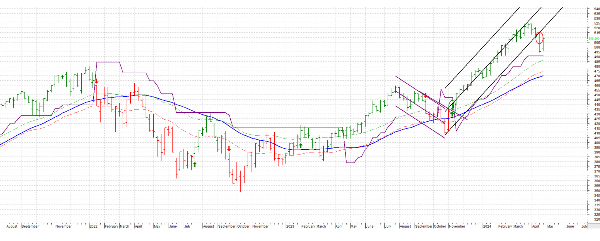

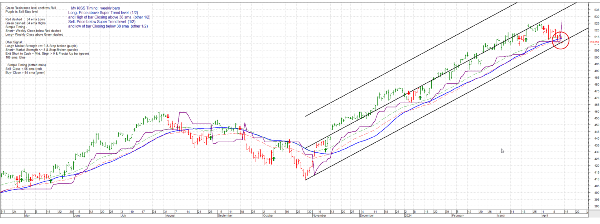

But are they an investment opportunity? Well unfortunately right now their stock is going through the classic penny stock slow death:

This happens when a bunch of believers come in, only to be disappointed with the results and start to shed away their shares. What’s frustrating is that the company’s revenue is solid; however, they haven’t been able to make a profit yet, which is likely keeping them from building new content channels and communities at the appropriate growth rate.

Immersive Technologies (IMMR)

Immersive Technologies is a pure-play investment in all solutions surrounding touch in technology. While they have multiple patents used by OEMs like Sony, Microsoft, and Nintendo, their technology also resides in vehicle touch screens.

The company has proven that their technology is in demand, and have even made positive earnings since 2020. Their revenue has ultimately been flat during that same time period, which hopefully means they have optimized earning cashflow, which is now capital that can be utilized to find new markets for their technology.

In their annual report, they note that growth in virtual reality and augmented reality could have a positive effect for their company. If demand grows for more realism in VR gaming, touch technology could prove vital in creating an experience that really does go beyond what a gamer finds on their tv or phone.

And if this technology enhancement proves itself in the market, Immersive Technologies has proven they are experts in touch interface technology and would benefit from the shift towards touch technology in VR gaming.

Super League Gaming (SLGG), an Actual Pure Play in the Metaverse

Now this is a great metaverse company. Advertising in the metaverse is becoming in line with billboards and traditional web media; however, advertising in the metaverse is also evolving into 3-D ads. This is the specialty Super League Gaming is focused on.

This company really is a pure play in the metaverse. All their energy is focused on disrupting traditional online media with 3-D offerings. The company is behind some of the most hyped ad campaigns in a metaverse world:

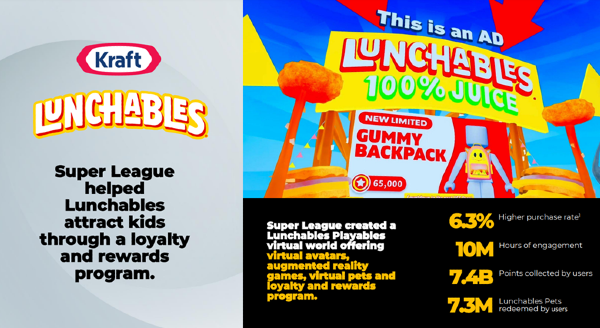

Kraft Lunchables Roblox Experience

This Roblox experience was an Obby run (a kind of Roblox obstacle course) that the company helped Kraft create. You can experience the game yourself here.

The company also worked on other 3-D experiences with Maybelline, Chipotle, and Mattel.

In fact, they work with a whole host of major name brands:

Super Gaming League’s Financials

So here comes the cold water. The company’s earnings are not improving and their revenue, which jumped after the metaverse craze in 2021, has been muted but still maintaining. SLGG revenue in 2023 has remained flat at $20 million in 2023. That is still good considering the company was only making $1 million in 2019.

But the growth must continue. In their annual report, the company notes that the bulk of their revenue comes from virtual gaming worlds in Minecraft and Roblox. Hence, their revenue will be tied to the success of the Roblox and Minecraft metaverses.

The new ad platform created by Roblox could have an impact on Super Gaming League as the platform is looking to simplify ads. As SLGG focuses on complex virtual worlds and the coding of these worlds, they could take a hit if metaverse advertising simplifies to 2-D billboard style advertising.

Matterport (MTTR)

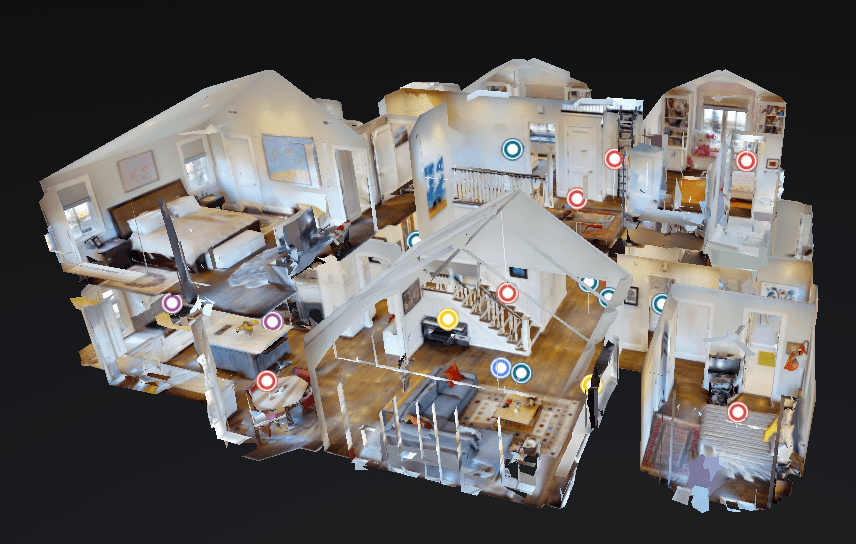

Matterport is a serious technology company. They are currently at a $1.4 billion market capitalization, and the company probably deserves that valuation. The company scans a space, like a house for sale, and digitizes the 3-D space so that a user can walk through the space digitally.

Before even knowing about this stock, I’ve used their technology before when looking to buy a house. The technology is pragmatic and seamless.

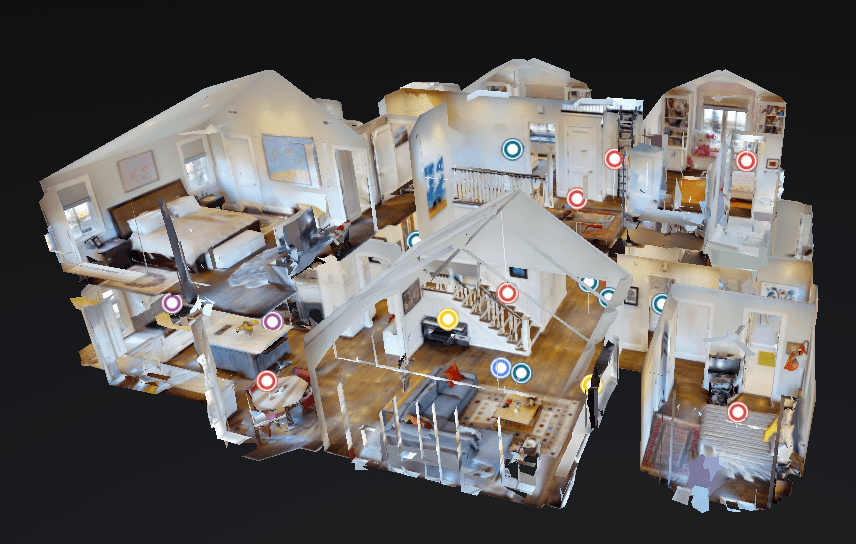

3D tour of house using Matterport technology

Matterport revenue has continued to increase year-over-year with a CAGR of 31%. The company is nearing profitability and has a very healthy runway thanks to their IPO. All revenue metrics including subscriptions point to continued growth with the company’s latest quarterly forecasting continued growth through 2024.

But is this a metaverse stock? Absolutely, right now the company is penetrating the markets that matter the most. Home buying critically needs digital tours to remove selling friction in the process. Construction and facility management all can be helped with Matterport as a monitoring tool. Matterport’s technology will naturally be migrated into the metaverse. Imagine playing a game of Fortnite in the Louvre. Vacationers can jump into the metaverse to see Cancun resorts before they decide to go.

Content creators will figure out ways to incorporate Matterport technology into their experiences.

But at the end of the day, you’ve likely missed your opportunity to invest. Matterport canceled their Q1 2024 results as they are being acquired by Costar Group (CSGP), likely in Q2 2024.

Izea Worldwide (IZEA)

Izea Worldwide is a scrappy company. It’s been in online advertising since the early 2000’s and is looking to really capitalize on scalable influencer marketing campaigns and AI. The company has some work to do to accelerate its revenue growth, but its latest tools really look like they can penetrate further into influencer marketing.

Izea worldwide has great software that works as expected. You can find an influencer and place a bid for them to create content for you.

In terms of the metaverse, their connection with this growing technology is minimal, and they could be hurt by the growth of metaverse’s as attention towards influencers turns to the metaverse. This is true for generation z and generation alpha, though these generations still turn to social media to see influencers play games in the metaverse.

Final Thoughts

The metaverse is already a very speculative mega trend, so tread carefully in the small-caps and penny stocks vying for market share in the metaverse. Many of the companies seem to have scaling issues, especially the digital advertising companies.

For example, Enthusiast Gaming Holdings has acquired a lot of great assets, making them basically a content holding company. To sustain growth, they need capital to acquire more great content, which they are currently not generating through profits.

The technology stocks all are very niche. They all basically will need to be bought out to realize investor value. Matterport is a classic example of this. Immersive Technologies (IMMR) has the technology to get acquired, but because of their niche they may never scale to become a mid-cap stock.

Hopefully this guide helps you find that up-and-coming metaverse stock that is right for you. Invest carefully in these new companies. They are trying to find their footing in a new sector.

Read More

Investments in Metaverse Stocks

How the Metaverse Makes Money

Metaverse Investment Analysis

Key Takeaways

The Metaverse Penny Stock Landscape

In the metaverse penny stock universe, there are two broad categories. The first are ever-evolving media companies. These companies are conducting advertising in exciting new ways. Some are penetrating virtual 3-D advertising, while others are all-in on influencer marketing. These companies are advertising in ways that would be unrecognizable 10 years ago and are using the metaverse to showcase these ads.

The other side of the penny stock landscape are technology startups. There are companies trying to create new hardware or new technologies that support the metaverse. The most successful in this category is Matterport (MTTR) which is digitizing home properties for online tours. Unfortunately, Matterport will soon be bought out.

What is Meta Materials (MMAT)?

Meta Materials is a materials research company in which a portion of their products could penetrate certain metaverse hardware markets. From looking at a variety of meta materials products, the company has a very small footprint in metaverse related businesses.

The closest business is optical in the augmented reality sub-sector. Meta Material augmented reality products look to be in advanced stages of research, but possibly not in full scale production with an OEM (original equipment manufacturer). An OEM in this segment would be a company like Meta Platforms; however, being that their annual revenue is low (no more than $10 million), they probably do not yet have a major OEM contract for their augmented reality products like Holo Optix.

Example of meta material augmented reality products

So, they aren’t really a great stock to get into the metaverse. The company is into research and development of materials, and they aren’t really focused enough on metaverse optics to be a serious player in augmented reality, for now.

Looking at their product selections, they really seem to be too random with their product research. Besides the optical research, the company is researching a non-evasive glucose monitoring system. They are also involved in banknote security? That is a very far cry from the metaverse, augmented reality, and especially cryptocurrency.

The company’s revenue is just not existent. Right now in Q2 2024, they have a lot of opportunities but they are still looking for the right market for their products. Without any real financials, the company is not really a strong investment opportunity until they find that right market.

Metaverse Penetration: D-

Value Investment: F

Speculation Level: Very High

Gaming and Entertainment with Enthusiast Gaming (EGLXF)

Enthusiast Gaming is becoming a big player in a burgeoning new sub-sector. The company is focused on multiple channels that provide gaming entertainment. You can think of them as the ESPN of gaming, back when ESPN had just started to report on sports. The company has structured their offerings through different channels, with their first segment being YouTube and Twitch content. The next being competitive gaming teams and gaming events.

The company’s relevance in the metaverse is mixed. Again, they are the ESPN of e-sports. And they are creating content, communities around multiple games in different metaverses.

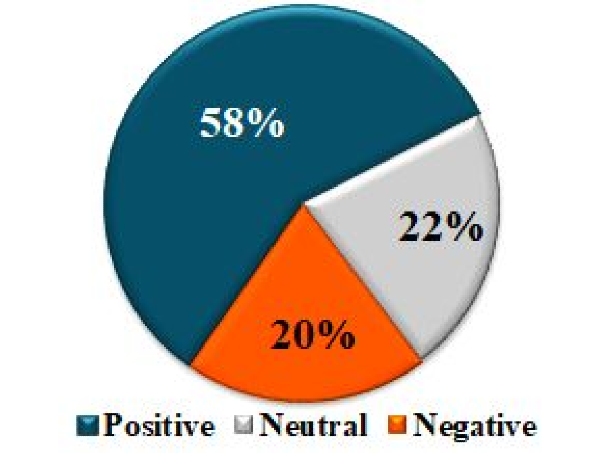

Source: Enthusiast Gaming Q4 2023 Presentation

The company has metaverse related content through Twitch, YouTube, and websites that create content about multiple metaverses. While some content creators in Enthusiast Gaming focus on specific games, others will cover a wide spectrum of games. Metaverses like Roblox, Battle.net, League of Legends, and Minecraft all get covered by the communities developed by Enthusiast Gaming Holdings.

But are they an investment opportunity? Well unfortunately right now their stock is going through the classic penny stock slow death:

This happens when a bunch of believers come in, only to be disappointed with the results and start to shed away their shares. What’s frustrating is that the company’s revenue is solid; however, they haven’t been able to make a profit yet, which is likely keeping them from building new content channels and communities at the appropriate growth rate.

Metaverse Penetration: C+

Value Investment: C-

Speculation Level: High

Immersive Technologies (IMMR)

Immersive Technologies is a pure-play investment in all solutions surrounding touch in technology. While they have multiple patents used by OEMs like Sony, Microsoft, and Nintendo, their technology also resides in vehicle touch screens.

The company has proven that their technology is in demand, and have even made positive earnings since 2020. Their revenue has ultimately been flat during that same time period, which hopefully means they have optimized earning cashflow, which is now capital that can be utilized to find new markets for their technology.

In their annual report, they note that growth in virtual reality and augmented reality could have a positive effect for their company. If demand grows for more realism in VR gaming, touch technology could prove vital in creating an experience that really does go beyond what a gamer finds on their tv or phone.

And if this technology enhancement proves itself in the market, Immersive Technologies has proven they are experts in touch interface technology and would benefit from the shift towards touch technology in VR gaming.

Metaverse Penetration: C+

Value Investment: C

Speculation Level: Medium

Super League Gaming (SLGG), an Actual Pure Play in the Metaverse

Now this is a great metaverse company. Advertising in the metaverse is becoming in line with billboards and traditional web media; however, advertising in the metaverse is also evolving into 3-D ads. This is the specialty Super League Gaming is focused on.

This company really is a pure play in the metaverse. All their energy is focused on disrupting traditional online media with 3-D offerings. The company is behind some of the most hyped ad campaigns in a metaverse world:

Kraft Lunchables Roblox Experience

This Roblox experience was an Obby run (a kind of Roblox obstacle course) that the company helped Kraft create. You can experience the game yourself here. The company also worked on other 3-D experiences with Maybelline, Chipotle, and Mattel.

In fact, they work with a whole host of major name brands:

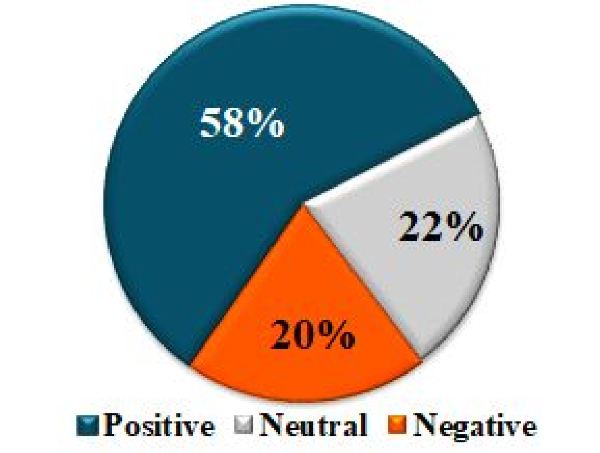

Source: SLGG investor relations

Super Gaming League’s Financials

So here comes the cold water. The company’s earnings are not improving and their revenue, which jumped after the metaverse craze in 2021, has been muted but still maintaining. SLGG revenue in 2023 has remained flat at $20 million in 2023. That is still good considering the company was only making $1 million in 2019.

But the growth must continue. In their annual report, the company notes that the bulk of their revenue comes from virtual gaming worlds in Minecraft and Roblox. Hence, their revenue will be tied to the success of the Roblox and Minecraft metaverses.

The new ad platform created by Roblox could have an impact on Super Gaming League as the platform is looking to simplify ads. As SLGG focuses on complex virtual worlds and the coding of these worlds, they could take a hit if metaverse advertising simplifies to 2-D billboard style advertising.

Metaverse Penetration: A

Value Investment: B

Speculation Level: Medium

Matterport (MTTR)

Matterport is a serious technology company. They are currently at a $1.4 billion market capitalization, and the company probably deserves that valuation. The company scans a space, like a house for sale, and digitizes the 3-D space so that a user can walk through the space digitally.

Before even knowing about this stock, I’ve used their technology before when looking to buy a house. The technology is pragmatic and seamless.

3D tour of house using Matterport technology

Matterport revenue has continued to increase year-over-year with a CAGR of 31%. The company is nearing profitability and has a very healthy runway thanks to their IPO. All revenue metrics including subscriptions point to continued growth with the company’s latest quarterly forecasting continued growth through 2024.

But is this a metaverse stock? Absolutely, right now the company is penetrating the markets that matter the most. Home buying critically needs digital tours to remove selling friction in the process. Construction and facility management all can be helped with Matterport as a monitoring tool. Matterport’s technology will naturally be migrated into the metaverse. Imagine playing a game of Fortnite in the Louvre. Vacationers can jump into the metaverse to see Cancun resorts before they decide to go.

Content creators will figure out ways to incorporate Matterport technology into their experiences.

But at the end of the day, you’ve likely missed your opportunity to invest. Matterport canceled their Q1 2024 results as they are being acquired by Costar Group (CSGP), likely in Q2 2024.

Metaverse Penetration: B-

Value Investment: A

Speculation Level: Medium

Izea Worldwide (IZEA)

Izea Worldwide is a scrappy company. It’s been in online advertising since the early 2000’s and is looking to really capitalize on scalable influencer marketing campaigns and AI. The company has some work to do to accelerate its revenue growth, but its latest tools really look like they can penetrate further into influencer marketing.

Izea worldwide has great software that works as expected. You can find an influencer and place a bid for them to create content for you.

In terms of the metaverse, their connection with this growing technology is minimal, and they could be hurt by the growth of metaverse’s as attention towards influencers turns to the metaverse. This is true for generation z and generation alpha, though these generations still turn to social media to see influencers play games in the metaverse.

Metaverse Penetration: C-

Value Investment: C

Speculation Level: High

Final Thoughts

The metaverse is already a very speculative mega trend, so tread carefully in the small-caps and penny stocks vying for market share in the metaverse. Many of the companies seem to have scaling issues, especially the digital advertising companies.

For example, Enthusiast Gaming Holdings has acquired a lot of great assets, making them basically a content holding company. To sustain growth, they need capital to acquire more great content, which they are currently not generating through profits.

The technology stocks all are very niche. They all basically will need to be bought out to realize investor value. Matterport is a classic example of this. Immersive Technologies (IMMR) has the technology to get acquired, but because of their niche they may never scale to become a mid-cap stock.

Hopefully this guide helps you find that up-and-coming metaverse stock that is right for you. Invest carefully in these new companies. They are trying to find their footing in a new sector.

Read More

Investments in Metaverse Stocks

How the Metaverse Makes Money

Metaverse Investment Analysis