BorgWarner is a name that offers an insightful case study on valuation. Known for its role in the automotive industry, particularly as it transitions into the EV sector, BorgWarner provides critical lessons for investors. Chuck Carnaval, aka Mr. Valuation, shares his analysis through a Fast Graphs two-minute drill, shedding light on the company's strong fundamentals and current undervaluation. Here's a breakdown.

Understanding BorgWarner’s Semi-Cyclical Earnings

BorgWarner’s adjusted operating earnings display a semi-cyclical nature:

- COVID Impact: During the pandemic, the company experienced two years of negative earnings growth.

- Post-Pandemic Recovery: Earnings have shown consistent growth since, which emphasizes the company's operational resilience.

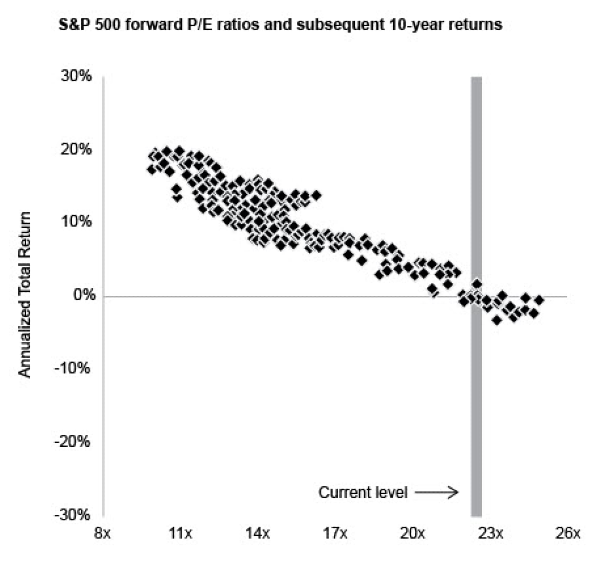

Market Undervaluation and Growth Potential

Despite these earnings improvements, BorgWarner's stock price has been undervalued for an extended period. The market appears to be overreacting to broader concerns in the automotive industry, particularly regarding the shift to EVs. However, this mispricing creates significant opportunities for long-term investors.

Key Growth Forecasts and Returns:

- Earnings Growth Rate: BorgWarner is forecast to grow earnings by 5.38% annually, based on analysts' projections.

- Potential Returns:

- At a PE ratio of 10 (the company’s historical norm), investors could realize an impressive 22% annualized return.

- If the stock price aligns with a PE ratio of 15, returns could exceed 40% annually over the next few years.

Dividend Stability and Free Cash Flow

BorgWarner offers additional appeal through its dividend:

- Low Free Cash Flow Payout Ratio: The company’s free cash flow to equity significantly exceeds its dividend payouts. With a payout ratio in the 20% range, the dividend appears well-supported and sustainable.

- Steady Income Stream: Investors benefit from a reliable dividend yield as they await stock price alignment with intrinsic value.

Navigating Market Concerns

The stock has faced headwinds due to light earnings guidance and skepticism about the automotive sector’s transition to electric vehicles (EVs). However, these concerns have led to an overreaction in the market:

- Undervalued PE Ratio: Currently trading at a 6.67 PE ratio, BorgWarner is priced far below even its historical PE norm of 9.92.

- Strong Fundamentals: The company's operational stability and growth potential remain intact, making it a compelling value proposition.

The Investment Opportunity

For investors willing to hold BorgWarner over a 3-to-5-year horizon, the potential for value realization is significant:

- Alignment of the stock price with intrinsic value could generate substantial returns.

- Dividend payouts provide a cushion while awaiting price normalization.

- Continued growth and favorable valuation shifts could yield outsized performance.

Final Thoughts

BorgWarner exemplifies how market mispricing can create opportunities for disciplined investors. While short-term sentiment remains muted, the company’s fundamentals and low valuation multiples point to strong long-term potential. As Chuck Carnaval aptly demonstrates, the key to successful investing lies in identifying value and maintaining a forward-looking perspective.

https://youtu.be/hCv6aVAqZi4?si=viS9KYPjX_Dv4lUf

BorgWarner is a name that offers an insightful case study on valuation. Known for its role in the automotive industry, particularly as it transitions into the EV sector, BorgWarner provides critical lessons for investors. Chuck Carnaval, aka Mr. Valuation, shares his analysis through a Fast Graphs two-minute drill, shedding light on the company's strong fundamentals and current undervaluation. Here's a breakdown.

Understanding BorgWarner’s Semi-Cyclical Earnings

BorgWarner’s adjusted operating earnings display a semi-cyclical nature:

Market Undervaluation and Growth Potential

Despite these earnings improvements, BorgWarner's stock price has been undervalued for an extended period. The market appears to be overreacting to broader concerns in the automotive industry, particularly regarding the shift to EVs. However, this mispricing creates significant opportunities for long-term investors.

Key Growth Forecasts and Returns:

Dividend Stability and Free Cash Flow

BorgWarner offers additional appeal through its dividend:

Navigating Market Concerns

The stock has faced headwinds due to light earnings guidance and skepticism about the automotive sector’s transition to electric vehicles (EVs). However, these concerns have led to an overreaction in the market:

The Investment Opportunity

For investors willing to hold BorgWarner over a 3-to-5-year horizon, the potential for value realization is significant:

Final Thoughts

BorgWarner exemplifies how market mispricing can create opportunities for disciplined investors. While short-term sentiment remains muted, the company’s fundamentals and low valuation multiples point to strong long-term potential. As Chuck Carnaval aptly demonstrates, the key to successful investing lies in identifying value and maintaining a forward-looking perspective.

https://youtu.be/hCv6aVAqZi4?si=viS9KYPjX_Dv4lUf