December 2022 Passive Income

- 3 sources of passive Income

- $1,040.43 from dividends

- 13 stocks dripped in December

- Trailing 12 Month Portfolio Return 0.82%

- S&P 500 12 Month Total Return* -18.11% for December 2022

S&P/TSX Composite Index 12 Month -4.32% Dec 2022

Hey Hey Hey

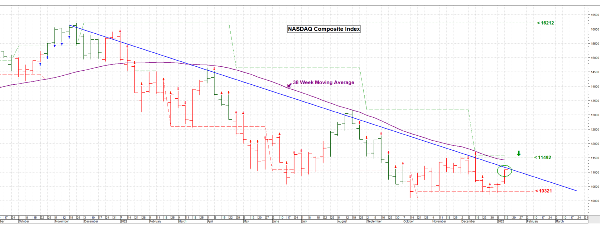

A new year has come. Man oh man did 2022 ever fly by? The market continues its downward spiral and we can see even better prices out there for long term investors. I think this will continue for at least the first half of 23, but who knows. Energy, Inflation and higher interest rates continue to hurt and increase people’s cost of living, but the governments continue to print money – devaluing our dollars. This could lead to even higher stock prices in dollar terms.

We continue to dollar cost average into quality dividend stocks, while also putting some cash aside for the end of the winter. (I’ve mentioned how I think banks, reits etc are going to be in for a rough winter due to economic pressures)

Life

At the beginning of December we went on a family trip with the kids to the Dominican. Was a great time to relax, drink a lot, eat a lot and soak up the sun. Our flight back got delayed multiple times and ended up being delayed over 7 hours. Sunwing gave us some food vouchers for the airport and handed us a pamphlet saying we could be eligible for 250 back per person for the delay. I tried applying for that on the site but got told we won’t get anything because it was a safety issue. We keep trying to call them to talk but can never get a hold of them.. What a mess.

At the same time we landed at pearson airport at about 3.30 in the morning and was probably the last flight of the night, so customs went extremely fast as everyone wanted to go home it seemed. That was nice!

Christmas was quiet and spread out this year. The trip was part of the kids gifts, which they understood. We got them still quite a bit of stuff but it seems the days of all these tiny polly pockets etc are over! That’s awesome since I find myself always cleaning up all these small toys.

I gained quite a bit of weight from the trip and Christmas but my gym is in the garage and its too cold, I haven’t been motivated to push weights. So we decided to buy a Bowflex ultimate 2. I had a very basic bowflex way back and loved it but maxed the weights and sold it for free weights. This one literally has everything including a rower. (which is something I love to do)

I also started a new ball hockey league this month. While I used to play with a group of friends in a school gym this is a real league, with penalties and points tracking etc. When I started we were 0-3. So far since I joined we won 7-2 and tied the best team 6-6 the other day. I’m not gonna say I’m the goat or anything, but we are undefeated since… haha

My legs and muscles needed the bowflex and hockey. I’m glad to be back. One of my main goals for 2023 is to get to 190 lbs. I’m currently 213. While my dad bod is aigghht, it could be tigghht. Know what I’m saying? haha Let’s go!

Alright, Let’s Get To Our December 2022 Passive Income

Raises

0 Raises this month, but that was to be expected as every stock we own currently besides xaw etf and disney raised their dividend in 2022.

Total Added Income from Dividend Raises in 2022 – $537.09

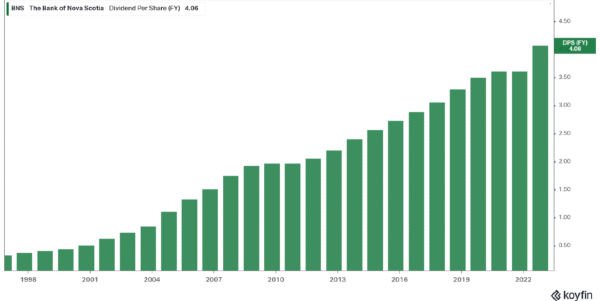

Since our portfolio currently brings in $8,360 yearly these raises alone added just over 7% to our income during 2022. This is the power of dividend growth investing. Moving forward I plan on adding more or beefing up lower yielding/ higher dividend growth positions in the portfolio. Let’s see if we can surpass 7% at the end of 2023.

December 2022 Dividend Income

12 Companies paid us this month.

13 stocks Dripped in December.

13 stocks Dripped in December.

After last months single drip, it’s nice to see more stocks dripping. Brookfield Renewable stands out as last year it only had 1 drip and here we are close to 4 drips. I may add to this position to get it next time.

If your interested check out our Previous Dividend Income Reports.

Our Drips (Dividend Reinvestment Program) added a monster $30.79 in future dividends.

Other Income

Private Investment Payment – $1000.00

1k a month, Straight to the heloc.

Solar Panel Income

In November (We always get paid a month later) our solar panel system generated 215.38 kWh. Since we bring in a fixed rate of 28.8 cents per kilowatt hour, Hydro One deposited $61.96 into our chequing account this month.

Last November the system generated $66.79 so we are slightly lower. Winter months for solar definitely don’t do much.

Total Income for 2022 – $2,287.07

System Installed January 2018

Total System Cost ——–$32,396.46

Total Income Received ——–$12,172.29

Amount to Break even —- $ –20,224.17

Clearly we can see these yearly numbers slowly decrease, is it the panels or is our tree just growing so much its blocking them more and more? I dunno. I keep debating topping the tree back a bit, maybe 5-10 ft?

Total December 2022 Passive Income – $2,102.39

December 2021 Passive Income – $1,480.73

Year over year we see an increase of $621.66 in passive income this month or a 41.98% growth rate. Sweet. A great end to the year.

Totals For 2022

Dividends Year To Date Total – $10,692.84

Other Passive Income Year to date – $13,491.23

Total Passive Income for 2022 —– $24,184.07

Year End Goal – $25,000

We fell short of our goal for the year but we also did change our strategy when interest rates showed no signs of slowing down. You can read about that here. At the end of 2021 we tallied up our total passive income and it sat at $17,009.91. I’ll happily take an extra $7,000 year over year increase to our passive income. It’s kinda blows my mind how much it has grown in only 7 years. Moral of the story – start investing now.

December Stock Purchases/ Sales

Let’s start this off with 1 sale.

Franco Nevada

We sold our position already in Franco Nevada. This one just ran up so fast from when I bought it and at over 194 per share, I didn’t see us wanting to add to the position. We bought 12 shares Sept 8 for 158 per share, so we locked in a 24% gain in roughly 4 months. This sale lost $15.36 in forward income.

Td Bank

This is a stock I always liked but sold off when I deleveraged the portfolio. I continue to think bank stock prices will get hurt moving forward but wanted to start averaging back into our position after they announced that 8% dividend raise in November. The proceeds of the franco nevada sale and new cash were used here.

We bought 44 shares of Td bank at $86.33 per share. Now you may be wondering, but Rob you sold your position in td before at 84.90 per share. That’s a bad play. Yes in the short term it is but like I mentioned above I think we will get td even cheaper in 2023. I sold 194 shares, this purchase is only a quarter of what I had. I’m just starting to average back into our position.

This purchase added $168.96 to our forward dividends.

In total we added $153.60 in future passive income this month.

Bitcoin

Part of the reason for my sale of Franco Nevada was that I’m also hedging against the dollar with our bitcoin position. As I’ve stated before this is purely a speculative investment and I won’t be throwing large stacks at it.

My plan for bitcoin is 100 to start and 20 bucks added every week. I’ll update how things are going every month.

Total invested – $230

I decided to go with shakepay because it is regulated in Canada and you shake the phone daily to get some free sats (bitcoin). I shake everyday and with a 45 day streak, I’m now getting about 6 cents a day in free bitcoin.

A 100 dollar deposit gets you 10 bucks and 10 for the referrer. Feel free to use my affiliate here if your interested in trying out the crypto space. I appreciate the support.

Financial Goals Update

Charities

Increase Dividends by $4285.81 this year. (bringing our forward income from dividends to $13,000 a year)

Unfortunately I’m going to disregard this now. While we could of been really close to hitting this, things changed. I’m not as bullish on the market and with interest rates doubling in 6 months (and still growing) I decided to pay off all our heloc which we used for investing. As long as the forward passive income is higher at yr end vs last yr, its all good!

Etf Monthly Minimum Purchase of $250

- This month we added 6 more units of xaw etf.

- Questrade* is great because it offers free etf trades and cheaper stock trading options than most Canadian brokers. $250.00 a month would kill us if we needed to pay high trading fees.

- *Note the questrade link is a affiliate link and at no additional cost to you, I would get a little payment if you were to sign up. You could get $50 in free trades by using my affiliate link though.

December 2022 Passive Income Conclusion

Its safe to say that 2022 was a great year on the passive income front. Overall it increased by quite a bit. As we start 2023 its time to once again reevaluate the portfolio and the moves we are making. I plan on continuing to increase the overall growth portion of the portfolio. The higher yielding companies tend to always be the ones, that you question. Meanwhile the lower yielding ones increase their dividend significantly and the stock price climbs as well.

Wish you all nothing but peace, love, happiness and health in 2023. May it bring you everything you truly want.

Attract what you expect, Reflect what you desire, Become what you expect, Mirror what you admire – unknown

December 2022 Passive Income

S&P/TSX Composite Index 12 Month -4.32% Dec 2022

Hey Hey Hey

A new year has come. Man oh man did 2022 ever fly by? The market continues its downward spiral and we can see even better prices out there for long term investors. I think this will continue for at least the first half of 23, but who knows. Energy, Inflation and higher interest rates continue to hurt and increase people’s cost of living, but the governments continue to print money – devaluing our dollars. This could lead to even higher stock prices in dollar terms.

We continue to dollar cost average into quality dividend stocks, while also putting some cash aside for the end of the winter. (I’ve mentioned how I think banks, reits etc are going to be in for a rough winter due to economic pressures)

Life

At the beginning of December we went on a family trip with the kids to the Dominican. Was a great time to relax, drink a lot, eat a lot and soak up the sun. Our flight back got delayed multiple times and ended up being delayed over 7 hours. Sunwing gave us some food vouchers for the airport and handed us a pamphlet saying we could be eligible for 250 back per person for the delay. I tried applying for that on the site but got told we won’t get anything because it was a safety issue. We keep trying to call them to talk but can never get a hold of them.. What a mess.

At the same time we landed at pearson airport at about 3.30 in the morning and was probably the last flight of the night, so customs went extremely fast as everyone wanted to go home it seemed. That was nice!

Christmas was quiet and spread out this year. The trip was part of the kids gifts, which they understood. We got them still quite a bit of stuff but it seems the days of all these tiny polly pockets etc are over! That’s awesome since I find myself always cleaning up all these small toys.

I gained quite a bit of weight from the trip and Christmas but my gym is in the garage and its too cold, I haven’t been motivated to push weights. So we decided to buy a Bowflex ultimate 2. I had a very basic bowflex way back and loved it but maxed the weights and sold it for free weights. This one literally has everything including a rower. (which is something I love to do)

I also started a new ball hockey league this month. While I used to play with a group of friends in a school gym this is a real league, with penalties and points tracking etc. When I started we were 0-3. So far since I joined we won 7-2 and tied the best team 6-6 the other day. I’m not gonna say I’m the goat or anything, but we are undefeated since… haha

My legs and muscles needed the bowflex and hockey. I’m glad to be back. One of my main goals for 2023 is to get to 190 lbs. I’m currently 213. While my dad bod is aigghht, it could be tigghht. Know what I’m saying? haha Let’s go!

Alright, Let’s Get To Our December 2022 Passive Income

Raises

0 Raises this month, but that was to be expected as every stock we own currently besides xaw etf and disney raised their dividend in 2022.

Total Added Income from Dividend Raises in 2022 – $537.09

Since our portfolio currently brings in $8,360 yearly these raises alone added just over 7% to our income during 2022. This is the power of dividend growth investing. Moving forward I plan on adding more or beefing up lower yielding/ higher dividend growth positions in the portfolio. Let’s see if we can surpass 7% at the end of 2023.

December 2022 Dividend Income

12 Companies paid us this month. 13 stocks Dripped in December.

13 stocks Dripped in December.

After last months single drip, it’s nice to see more stocks dripping. Brookfield Renewable stands out as last year it only had 1 drip and here we are close to 4 drips. I may add to this position to get it next time.

If your interested check out our Previous Dividend Income Reports.

Our Drips (Dividend Reinvestment Program) added a monster $30.79 in future dividends.

Other Income

Private Investment Payment – $1000.00

1k a month, Straight to the heloc.

Solar Panel Income

In November (We always get paid a month later) our solar panel system generated 215.38 kWh. Since we bring in a fixed rate of 28.8 cents per kilowatt hour, Hydro One deposited $61.96 into our chequing account this month.

Last November the system generated $66.79 so we are slightly lower. Winter months for solar definitely don’t do much.

Total Income for 2022 – $2,287.07

System Installed January 2018

Total System Cost ——–$32,396.46

Total Income Received ——–$12,172.29

Amount to Break even —- $ –20,224.17

Clearly we can see these yearly numbers slowly decrease, is it the panels or is our tree just growing so much its blocking them more and more? I dunno. I keep debating topping the tree back a bit, maybe 5-10 ft?

Total December 2022 Passive Income – $2,102.39

December 2021 Passive Income – $1,480.73

Year over year we see an increase of $621.66 in passive income this month or a 41.98% growth rate. Sweet. A great end to the year.

Totals For 2022

Dividends Year To Date Total – $10,692.84 Other Passive Income Year to date – $13,491.23 Total Passive Income for 2022 —– $24,184.07 Year End Goal – $25,000

We fell short of our goal for the year but we also did change our strategy when interest rates showed no signs of slowing down. You can read about that here. At the end of 2021 we tallied up our total passive income and it sat at $17,009.91. I’ll happily take an extra $7,000 year over year increase to our passive income. It’s kinda blows my mind how much it has grown in only 7 years. Moral of the story – start investing now.

December Stock Purchases/ Sales

Let’s start this off with 1 sale.

Franco Nevada

We sold our position already in Franco Nevada. This one just ran up so fast from when I bought it and at over 194 per share, I didn’t see us wanting to add to the position. We bought 12 shares Sept 8 for 158 per share, so we locked in a 24% gain in roughly 4 months. This sale lost $15.36 in forward income.

Td Bank

This is a stock I always liked but sold off when I deleveraged the portfolio. I continue to think bank stock prices will get hurt moving forward but wanted to start averaging back into our position after they announced that 8% dividend raise in November. The proceeds of the franco nevada sale and new cash were used here.

We bought 44 shares of Td bank at $86.33 per share. Now you may be wondering, but Rob you sold your position in td before at 84.90 per share. That’s a bad play. Yes in the short term it is but like I mentioned above I think we will get td even cheaper in 2023. I sold 194 shares, this purchase is only a quarter of what I had. I’m just starting to average back into our position.

This purchase added $168.96 to our forward dividends.

In total we added $153.60 in future passive income this month.

Bitcoin

Part of the reason for my sale of Franco Nevada was that I’m also hedging against the dollar with our bitcoin position. As I’ve stated before this is purely a speculative investment and I won’t be throwing large stacks at it.

My plan for bitcoin is 100 to start and 20 bucks added every week. I’ll update how things are going every month.

Total invested – $230

I decided to go with shakepay because it is regulated in Canada and you shake the phone daily to get some free sats (bitcoin). I shake everyday and with a 45 day streak, I’m now getting about 6 cents a day in free bitcoin.

A 100 dollar deposit gets you 10 bucks and 10 for the referrer. Feel free to use my affiliate here if your interested in trying out the crypto space. I appreciate the support.

Financial Goals Update

Charities

Increase Dividends by $4285.81 this year. (bringing our forward income from dividends to $13,000 a year)

Unfortunately I’m going to disregard this now. While we could of been really close to hitting this, things changed. I’m not as bullish on the market and with interest rates doubling in 6 months (and still growing) I decided to pay off all our heloc which we used for investing. As long as the forward passive income is higher at yr end vs last yr, its all good!

Etf Monthly Minimum Purchase of $250

December 2022 Passive Income Conclusion Its safe to say that 2022 was a great year on the passive income front. Overall it increased by quite a bit. As we start 2023 its time to once again reevaluate the portfolio and the moves we are making. I plan on continuing to increase the overall growth portion of the portfolio. The higher yielding companies tend to always be the ones, that you question. Meanwhile the lower yielding ones increase their dividend significantly and the stock price climbs as well.

Wish you all nothing but peace, love, happiness and health in 2023. May it bring you everything you truly want.

Originally Posted in Passive Canadian Income