Key Notes

- Fractional shares help build wealth at scale by making portfolio diversification simple

- Fractional Shares earn dividends

- Brokerages have dividend reinvestment programs for fractional shares

- Fractional shares are harder to sell than whole shares. But, the practical effects are minimal for typical long-term investment trades

Why Fractional Shares Builds Wealth at Scale

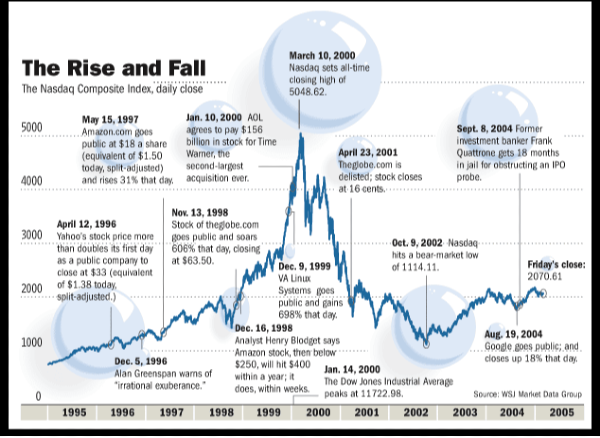

Fractional shares are a game changer. Fractional shares existed since the late 1990s[1]. But a broader audience discovered fractional shares in 2019. This was when brokerage firm Robinhood introduced them[2].

When online brokerages were first created, fractional shares were impractical. A single trade back in the 90s would cost up to $30. In the 2000s, each transaction was $9.99. If you made a single, $100 trade, it means that you immediately lost 10% of your investment buying the stock. For most people, this stranglehold meant they could not build a diversified portfolio. Buying a basket of 10 stocks at $100 each would mean they would lose 10% to commissions. Back then, it was better to buy $1000 of one stock, lose the 1% commission, and not be diversified.

Today, the average income is about $56,000[6]. and the average household saves about 4.4%[5]. That means the typical household saves $186 per month. Thanks to fractional shares, $186 can build a diversified portfolio. Commissions won't erode your returns and fractional shares let you buy any stock regardless of price.

Thanks to “no-commission” trades, there is no erosion to the average household's investments.

Why do Fractional Shares Exist?

Fractional shares allow people to invest in companies with large prices per share. Thanks to fractional shares, a stock price that's “too expensive” is irrelevant. This is because stock prices do not prohibit anyone from investing in that company. Since the price of a share is arbitrary, fractional shares have removed what was once an unnecessary hurdle for small investors.

Stocks like Berkshire Hathaway (BRK-A) has a price per share of $404k as of September 2022. This price is too expensive for typical retail investors. However, with fractional shares, you can buy class A shares of Berkshire Hathaway for $1.

Why Should I Buy Fractional Shares?

Fractional shares allow you to diversify your portfolio with 10 unique stocks for $10. This allows the investor to use strategies like dollar-cost averaging. This is where an investor periodically invests the same amount of money into an asset. This buys more shares of the asset as the price falls, reducing the impact of price volatility.

Fractional shares also allow small investors to run a rebalancing procedure. The Alaska Permanent Fund uses this strategy by setting percentage targets for asset allocation. When you set asset allocation targets, you choose a percentage an asset will have in your portfolio. When you set asset allocation targets, you choose a percentage an asset will have in your portfolio. For example, you could set a target of 10% allocation to Amazon. If Amazon doubles in value, it may become 20% of your portfolio. Your procedure will sell Amazon and reallocate to stocks that may be falling. This systematically helps you buy low (the reallocation), and sell high (Amazon doubling).

Fractional shares allow you to run this process even if your total portfolio value is less than $100. This is because the price of a whole share of Amazon is likely higher than $100. Fractional shares allow investors to reallocate assets without caring about share price.

How to Buy Fractional Shares

You can buy fractional shares from multiple brokerages. We recommend Robinhood and Fidelity because they provide fractional shares at a great price.

- Both sell fractional shares for $0.00 in commissions

- Both have a $1.00 minimum per trade

- Both provide $0.00 commissions for ADRs and OTC stocks.

Dividend Reinvestment Programs (DRIP)

Fractional shares do get paid dividends, though there is a limitation to how small a fractional share can be and still be eligible for a dividend. For Fidelity, this may be 0.001 shares[3].

Fidelity provides a program that will invest your dividends back as fractional shares. Your dividends will be invested in full. This allows your dividends to be reinvested without left over money sitting around.

Is There a Downside to Buying Fractional Shares?

- Fractional shares may not qualify for trading outside of trading hours[3].

- Trading may be limited to a mobile app

- You cannot vote for corporate actions with the fractional share position you hold

- Fractional shares may not be purchased at the quote price and may not have a liquid market for certain securities

Are Fractional Shares Harder to Sell?

For all practical purposes, fractional shares are not harder to sell. The difficulty of selling the share is determined by the liquidity of the underlying market and isn’t dependent on fractional shares.

Brokerages like Fidelity will have entities acting as your agent to hold the shares. This means that the agent holds the shares of multiple accounts with fractional shares. Any fractional shares are marked as “not held” [4]. This means that the agent is given time and price discretion to seek the best available price. Because of this discretion, your fractional share order may not be executed immediately.

For large cap and mid cap stocks, this will not be an issue for all practical purposes.

References

Key Notes

Why Fractional Shares Builds Wealth at Scale

Fractional shares are a game changer. Fractional shares existed since the late 1990s[1]. But a broader audience discovered fractional shares in 2019. This was when brokerage firm Robinhood introduced them[2].

Source: Robinhood.com

When online brokerages were first created, fractional shares were impractical. A single trade back in the 90s would cost up to $30. In the 2000s, each transaction was $9.99. If you made a single, $100 trade, it means that you immediately lost 10% of your investment buying the stock. For most people, this stranglehold meant they could not build a diversified portfolio. Buying a basket of 10 stocks at $100 each would mean they would lose 10% to commissions. Back then, it was better to buy $1000 of one stock, lose the 1% commission, and not be diversified.

Source giphy.com

Today, the average income is about $56,000[6]. and the average household saves about 4.4%[5]. That means the typical household saves $186 per month. Thanks to fractional shares, $186 can build a diversified portfolio. Commissions won't erode your returns and fractional shares let you buy any stock regardless of price. Thanks to “no-commission” trades, there is no erosion to the average household's investments.

Why do Fractional Shares Exist?

Fractional shares allow people to invest in companies with large prices per share. Thanks to fractional shares, a stock price that's “too expensive” is irrelevant. This is because stock prices do not prohibit anyone from investing in that company. Since the price of a share is arbitrary, fractional shares have removed what was once an unnecessary hurdle for small investors.

Stocks like Berkshire Hathaway (BRK-A) has a price per share of $404k as of September 2022. This price is too expensive for typical retail investors. However, with fractional shares, you can buy class A shares of Berkshire Hathaway for $1.

Why Should I Buy Fractional Shares?

Fractional shares allow you to diversify your portfolio with 10 unique stocks for $10. This allows the investor to use strategies like dollar-cost averaging. This is where an investor periodically invests the same amount of money into an asset. This buys more shares of the asset as the price falls, reducing the impact of price volatility.

Fractional shares also allow small investors to run a rebalancing procedure. The Alaska Permanent Fund uses this strategy by setting percentage targets for asset allocation. When you set asset allocation targets, you choose a percentage an asset will have in your portfolio. When you set asset allocation targets, you choose a percentage an asset will have in your portfolio. For example, you could set a target of 10% allocation to Amazon. If Amazon doubles in value, it may become 20% of your portfolio. Your procedure will sell Amazon and reallocate to stocks that may be falling. This systematically helps you buy low (the reallocation), and sell high (Amazon doubling).

Fractional shares allow you to run this process even if your total portfolio value is less than $100. This is because the price of a whole share of Amazon is likely higher than $100. Fractional shares allow investors to reallocate assets without caring about share price.

How to Buy Fractional Shares

You can buy fractional shares from multiple brokerages. We recommend Robinhood and Fidelity because they provide fractional shares at a great price.

Dividend Reinvestment Programs (DRIP)

Fractional shares do get paid dividends, though there is a limitation to how small a fractional share can be and still be eligible for a dividend. For Fidelity, this may be 0.001 shares[3]. Fidelity provides a program that will invest your dividends back as fractional shares. Your dividends will be invested in full. This allows your dividends to be reinvested without left over money sitting around.

Is There a Downside to Buying Fractional Shares?

Are Fractional Shares Harder to Sell?

For all practical purposes, fractional shares are not harder to sell. The difficulty of selling the share is determined by the liquidity of the underlying market and isn’t dependent on fractional shares.

Brokerages like Fidelity will have entities acting as your agent to hold the shares. This means that the agent holds the shares of multiple accounts with fractional shares. Any fractional shares are marked as “not held” [4]. This means that the agent is given time and price discretion to seek the best available price. Because of this discretion, your fractional share order may not be executed immediately. For large cap and mid cap stocks, this will not be an issue for all practical purposes.

References

1). Folio Investing Acquires Accounts of BUYandHOLD

2). Anyone can invest, even if it’s only with a $1 bill

3). Fidelity Stocks by the Slice

4). Fidelity Terms of Service

5). Here’s exactly how much money is in the average savings account in America (and psst: it’s a lot more than you might guess) by Alisa Wolfson

6). What Is a Good Salary? And How Do You Compare? by Mint