Tesla at All Time Highs

Recently, Tesla hit all time highs. I didn’t know Tesla’s stock price was climbing so rapidly, and don’t really care why it’s climbing now. (when I checked, the media thinks it’s because of a Hertz deal made Meh).

Why you should buy good companies and ignore the stock price.

I think it was 2013. Back then, I owned Tesla. One day, Tesla was up 60% from when I bought it. I thought I would be clever and take that 60% profit. Since then, I missed out on another 500% return on Tesla. So, in March of 2020, I bought Tesla again, and this time I intend to hold on for a bit longer.

Not all companies are, as I call them, “win more” companies. The vast majority of companies are “continue surviving” companies who have a CEO that just want to keep the ship sailing but not try to conquer any markets.

Tesla wants to do some conquering

Tesla dominates the market share of U.S. electric vehicles with 80% of the market in 2019. As they continue to take more market share of the EV market, they are also taking more market share of the car market in general.

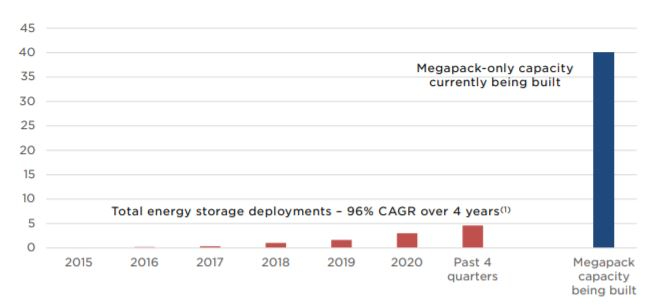

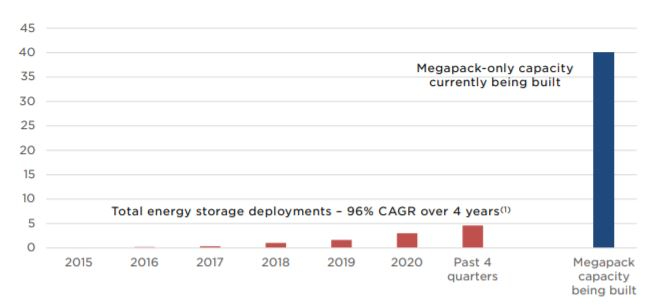

Tesla isn’t just in the car market. Their energy storage systems are taking market share at a considerable rate with their production increasing exponentially. The ability to store energy efficiently is critical in multiple industries like Solar energy and microgrids.

Culture Culture Culture

For Tesla, you really got to look at the culture to understand. Elon Musk will sleep under his desk at his plant if the plant isn’t performing. They have a radical work culture that is spearheaded by Elon. The guy doesn’t have the Midas touch (a lot of failed rockets, missed production schedules, and mean spiritedness towards employees), see his biggest failures here for that story, but this kind of drive is necessary to conquer markets. I’ve seen companies with $80 million in capital succeed, and I’ve seen companies with $125 million fail. Culture is more important that you might think in a companies success.

So, When Should you Sell Tesla?

For a “win more” company like Tesla, it’s all about culture. If you start seeing cracks in its culture, it may be time to get out. If you start seeing growth drop, and poor explanations start to come out of Tesla, hop off the band wagon. Hopefully, a better way to get out is when you find an even better “win more” company. Or maybe take out a little bit for yourself each time those sweet splits happen. And if Elon Musk starts his journey to Mars, it also maybe time to move your assets somewhere else.

I/we have a position in an asset mentioned

Tesla at All Time Highs

Recently, Tesla hit all time highs. I didn’t know Tesla’s stock price was climbing so rapidly, and don’t really care why it’s climbing now. (when I checked, the media thinks it’s because of a Hertz deal made Meh).

Why you should buy good companies and ignore the stock price.

I think it was 2013. Back then, I owned Tesla. One day, Tesla was up 60% from when I bought it. I thought I would be clever and take that 60% profit. Since then, I missed out on another 500% return on Tesla. So, in March of 2020, I bought Tesla again, and this time I intend to hold on for a bit longer.

Not all companies are, as I call them, “win more” companies. The vast majority of companies are “continue surviving” companies who have a CEO that just want to keep the ship sailing but not try to conquer any markets.

Tesla wants to do some conquering

Tesla dominates the market share of U.S. electric vehicles with 80% of the market in 2019. As they continue to take more market share of the EV market, they are also taking more market share of the car market in general. Tesla isn’t just in the car market. Their energy storage systems are taking market share at a considerable rate with their production increasing exponentially. The ability to store energy efficiently is critical in multiple industries like Solar energy and microgrids.

Culture Culture Culture

For Tesla, you really got to look at the culture to understand. Elon Musk will sleep under his desk at his plant if the plant isn’t performing. They have a radical work culture that is spearheaded by Elon. The guy doesn’t have the Midas touch (a lot of failed rockets, missed production schedules, and mean spiritedness towards employees), see his biggest failures here for that story, but this kind of drive is necessary to conquer markets. I’ve seen companies with $80 million in capital succeed, and I’ve seen companies with $125 million fail. Culture is more important that you might think in a companies success.

So, When Should you Sell Tesla?

For a “win more” company like Tesla, it’s all about culture. If you start seeing cracks in its culture, it may be time to get out. If you start seeing growth drop, and poor explanations start to come out of Tesla, hop off the band wagon. Hopefully, a better way to get out is when you find an even better “win more” company. Or maybe take out a little bit for yourself each time those sweet splits happen. And if Elon Musk starts his journey to Mars, it also maybe time to move your assets somewhere else.

I/we have a position in an asset mentioned