Sound investments

don't happen alone

Find your crew, build teams, compete in VS MODE, and identify investment trends in our evergrowing investment ecosystem. You aren't on an island anymore, and our community is here to help you make informed decisions in a complex world.

We saw again that this market is nearly addicted to low interest rates. Jay Powell indicated that the FED will not be aggressively tapering soon, hence interest rates will remain fairly low for awhile at least. The market loved it ! And so it goes. Market breath (both S&P and NASDAQ) have improved. (Breath: advance / declines, new highs 7 lows, up / down volume, # of stocks above 50 & 200 MA, etc.) Now with the RSI approaching 70 one could say that we're "over bought", but that can continue for a bunch longer. (more discussion at www.special-risk.net)

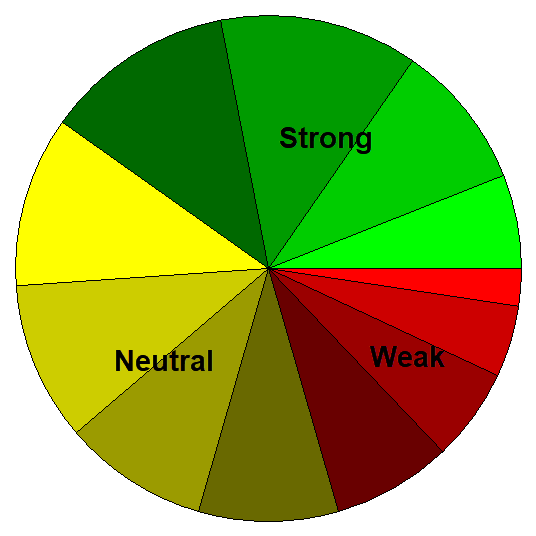

Here's the recovery of the stocks in the S&P 1500 Index as they relate to the 20 day Bollinger Bands:

I/we have a position in an asset mentioned